Roofstock vs. Fundrise: The Heavyweights of Real Estate Crowdfunding. Which Platform Reigns Supreme?

At a Glance:

KEY FEATURES | ||

QUICK SUMMARY | Marketplace to purchase and sell single-family rental homes across the United States. | Real estate investment platform that offers a wide variety of REITs and Funds with varying strategies and property types |

MINIMUM INVESTMENT | Varies | $10 |

FEES | Sellers: 3% fee of the sale price or $2,500 (whichever is greater)

Buyers: .5% of the purchase price, or $500 (whichever is greater) | 1%/yr |

INVESTMENT OPTIONS |

|

|

Who should use Roofstock and Fundrise?

Roofstock is a good option for…

Investors are interested in a direct physical real estate investment and are not concerned with hands-on property management.

Fundrise is a good option for…

Individuals who want real estate exposure but aren’t interested in the stress associated with owning a physical real estate property.

PROs and CONs

Roofstock PROS

- Enhanced vetting process

- 30-day money-back guarantee

- Easy to find investment properties

Roofstock CONS

- A high amount of capital required

- Limited liquidity

Fundrise PROS

- Lower correlation to the stock market compared to public REITs

- Historically higher returns than publicly-traded REITs

- Investor tools to pick real estate investments

Fundrise CONS

- Limited liquidity

- They don’t own and operate the investments.

What is Roofstock?

Roofstock is an online marketplace where non-accredited and accredited real estate investors can browse, compare, and ultimately buy or sell Single Family Rentals (SFRs) across 27 states.

Roofstock also provides property management services to investment property owners, plus the ability to purchase shares of a managed rental property portfolio if you are an accredited investor through its RoofstockOne platform.

Roofstock aims to make investing in Single Family Rentals accessible to all investors regardless of location.

Since its launch in 2015, the company has facilitated over $5 billion in real estate transactions.

Roofstock is headquartered in Oakland, CA.

Read our full Roofstock Review

What is Fundrise?

Fundrise is a real estate crowdfunding platform that offers non-accredited and accredited investors an alternative option to investing in real estate without the stress and costs of traditional real estate investing.

Individuals can invest in a wide range of eREITs and eFunds with a minimum investment of just $10, making Fundrise a great way to invest in real estate without buying property.

Fundrise boasts a wide variety of investment options and strategies, goal-planning features, and a user-friendly investment dashboard.

Over 300,000 people use Fundrise today and have invested over $7 billion in properties throughout the U.S. Fundrise has had 21 consecutive quarters of returns, averaging 22.99% in 2021.

Fundrise was founded in 2010 and is based in Washington, DC. The company was founded by Ben Miller, who has over 20 years of experience in the real estate industry.

Read our full Fundrise Review.

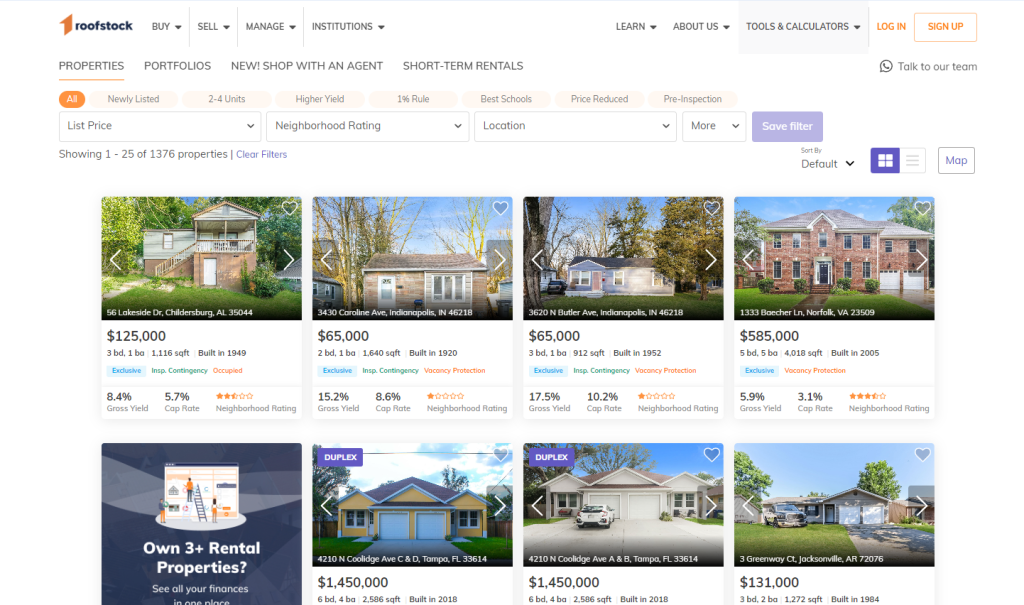

How does Roofstock work?

Roofstock is a marketplace where you can buy single-family residential rental investment properties across 27 states. The main difference between Roofstock and purchasing from Zillow or any other real estate website is that Roofstock is a “one-stop shop” for gathering all the details required for investment properties.

For example, Roofstock makes the research process faster by providing pictures and street views, floor plans, property inspection reports, current tenant lease information, and tenant payment history.

This makes a once-piecemeal research process seamless because you can vet multiple properties without missing details or e-mail follow-ups.

Users can browse properties based on the following details:

- Location

- Price

- Neighborhood rating

- Reduced price

- Cap rate

- Gross yield

- Monthly rent

All Properties listed for sale on the Roofstock marketplace are either occupied, which means you start earning cash flow as soon as you become an owner, or may come with vacancy protection, for which Roofstock ensures that you’ll secure a signed lease on your rent-ready home within 45 days, or they will cover your rent for up to 6 months.

When buying or selling through Roofstock, you execute a transaction like a traditional residential property transaction.

The main difference is that Roofstock is the facilitator of the deal while offering a 30-day money-back guarantee. Some properties also offer vacancy protection if your property is not already occupied.

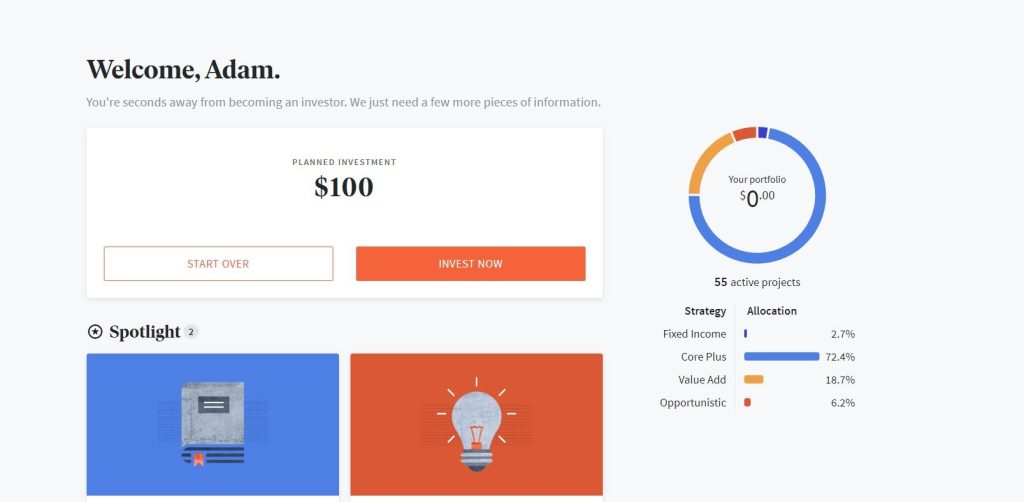

How Does Fundrise Work?

With Fundrise, you are investing in either Fundrise eREITs or eFunds with a minimum investment of $10.

eREITs and eFunds comprise a basket of non-traded real estate properties, from multifamily apartments to industrial complexes. The eREITs and eFunds seek a combination of dividend distribution and capital appreciation, depending on the strategy.

When you open an account with Fundrise, they offer a wide range of account levels. Basic accounts require a minimum investment of $10, and its Advanced Portfolio requires a minimum investment of $10,000. The premium level is reserved for accredited investors only, with a minimum investment of $100,000.

However, Fundrise’s most popular account is the ‘Core’ portfolio, which has the most investment options and features. A Core account requires a minimum investment of $5,000.

You can create a customized investment strategy at the Core account level and above. Investors can customize their portfolio by diversifying across various funds with specific objectives, such as income, growth, and balance.

Head-to-Head Comparison

Let’s look at how Roofstock and Fundrise compare against each other in three important categories: investment options, fees, and ease of use.

Roofstock vs. Fundrise: Investment options

The truth is that Roofstock and Fundrise offer two entirely different ways to invest and investment options.

With Roofstock, you can invest in single-family rentals across 27 states. You can get direct exposure to different real estate markets based on specific investment requirements you may have.

Meanwhile, Fundrise offers many investment options across its eREITs and eFunds.

The critical difference is that with Roofstock, you purchase a physical property with direct control over the investment. With Fundrise, you buy shares in a professionally managed REIT or fund and have zero control over the property management or investment strategy.

Fundrise and Roofstock provide ways to invest in private real estate markets, which can be a great hedge against inflation and diversify your investment portfolio outside traditional stocks, bonds, and ETFs.

Roofstock vs Fundrise: Fees

Roofstock and Fundrise have different fee structures due to the type of investments and nature of the transactions.

Roofstock doesn’t have any sign-up fees or recurring fees. Fees are only charged once a property is bought or sold. Meanwhile, because Fundrise is a REIT, they charge a 1% management fee for assets under management.

Fundrise fees align with other non-traded real estate crowdfunding platforms such as RealtyMogul.

Meanwhile, Roofstock’s fees total 3.5% all-in, which is about 1.5% – 2.5% cheaper than using a traditional real estate agent. According to real estate firm Redfin, conventional real estate agents have a 5 – 6% commission.

Roofstock Fees

- Sellers pay a 3% fee of the sale price or $2,500 (whichever is greater)

- Buyers pay a fee equal to 0.5% of the purchase price, or $500 (whichever is greater)

- No recurring fees

In addition, property owners are responsible for the other traditional property ownership costs such as:

- Mortgage

- Property taxes and insurance

- Maintenance and repairs

- Property management fees (if applicable)

Fundrise Fees

Fundrise charges a yearly asset management fee of 0.85% plus a 0.15% advisory fee, so 1 %/yr. All dividends are net of fees. For every $1,000 invested, you will pay $10 in fees.

Fundrise does not charge transaction fees, sales commissions, or additional fees for enabling features on your accounts, such as dividends or auto-investment.

- 0.85% management fee

- 0.15% advisory fee

- 1% early redemption fee (if an investment is sold before being held or 5 years)

Any redemptions processed before an investment is five years old is subject to a flat 1% penalty. After five years, investors can request to redeem their shares for their full value at any time, with no penalty applied.

Roofstock vs. Fundrise: Ease of Use

Roostock and Fundrise have an easy sign-up process and a very friendly user dashboard.

It typically takes less than 5 minutes to create an account and begin investing with Fundrise. You can open an account via the Fundrise website or mobile app. Once you open an account and select your plan, Fundrise can build a portfolio with dozens of projects that match your desired investment profile.

You can easily monitor and manage your investments from the Fundrise dashboard. The dashboard contains helpful tools and features such as real-time returns, in-depth project updates, accounts goals, set-up auto-invest, manual investments, and more.

Meanwhile, Roofstock’s easy-to-use Marketplace dashboard makes browsing and reviewing properties a breeze. You can filter on quantitative metrics such as cap rate and gross yield and metrics such as school rating and neighborhood ranking.

Roofstock can also connect you with financing providers, provide neighborhood rankings, and financing calculator tools, making a seamless user experience.

Which Platform is Better?

Roofstock and Fundrise offer two entirely different business models for investing in real estate.

Roofstock is a good option if you are dead set on a physical investment property but need a little handholding along the way.

However, given the large amount of capital required and limited liquidity options, I would not recommend Roofstock if this is your first foray into real estate investing. A good alternative if you are interested in single-family rentals, is Arrived Homes, which offers single-family investments starting at $100.

On the other hand, Fundrise may be a more practical approach to real estate investing, given its low minimum investment. Still, compared to publicly-traded REITs, there is limited liquidity, so you want to ensure a long-term investment horizon.

There is no “right” way to invest in real estate. It comes down to your time horizon, the amount of capital you have, and the type of strategy you are interested in.

There are plenty of ways to get rich through real estate.