Unraveling the Investment Maze: Real Estate vs. Stocks – Which Wealth-Building Powerhouse Reigns Supreme?

Purchasing real estate vs. stocks is a personal decision that depends on your risk tolerance, investment goals, and, sometimes, your personality.

There are plenty of stock market moguls like Warren Buffet and real estate moguls like Donald Bren, who built a multi-billion dollar empire across California and Manhattan.

Real estate investing has many benefits, like generating passive income and serving as an inflation hedge. At the same time, stock market investing can offer high returns and the ability to buy and sell your investments easily.

Investing in Real Estate

People primarily think of real estate investing as buying rental properties. There are various ways to invest in real estate. You can invest in real estate through a crowdfunding company like Groundfloor or a publicly-traded Real Estate Investment Trust.

However, this article focuses on physical real estate, like rental properties.

PROS of Real Estate

There are several advantages of real estate over stocks; let’s take a look below.

Real Estate is easier to understand

The economics of real estate are simple…maybe that’s why there are so many self-made real estate millionaires.

Profit earned through rental properties is the difference between your gross rental income less your mortgage, maintenance and repair expenses.

And unlike stocks, there are no 200-page financials or complicated accounting structures to read.

This brings me to my next point…

More Control

With real estate investing, you own a tangible asset and control all decisions.

From decisions like property upgrades and setting rental prices to non-financial choices like picking the bedroom door knobs.

Unlike stock market investing, you are the CEO of your mini real empire.

With this control comes a feeling of pride — you own a tangible asset that you can see and touch, while the rental income earned results from the fruits of your labors. Therefore, a certain feeling cannot be replicated through stock market investing.

You might also be interested in How to Build Wealth with Real Estate Investing.

Natural Inflation Hedge

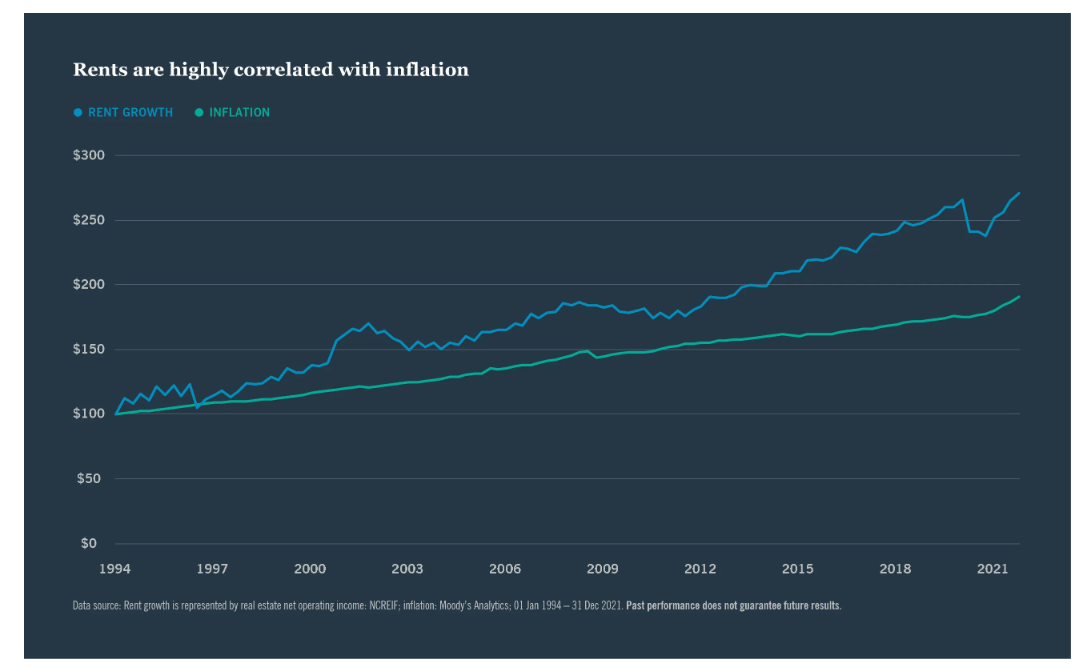

Real estate can serve as a natural inflation hedge.

Why?

As inflation increases, landlords can increase the rent as lease renewals occur.

The correlation between rent prices and inflation is well-documented.

A recent study from Nuveen Investments shows that rent growth is highly correlated with inflation and has outpaced inflation since 1994, as illustrated in the image below.

Secondly, as the economy heats up, housing demand increases because more people have money to buy real estate.

With a limited real estate supply, pent-up demand drives up prices.

And because housing is essential, increasing rent prices is easier because people will always need somewhere to live.

Many individuals will reduce non-essential items before moving to a new apartment or house.

Leverage

For real estate investors, leverage can magnify returns and expand your real estate portfolio while reducing the amount of cash needed to invest.

Leverage can be an incredibly powerful real estate investing tool.

To illustrate the power of leverage, let’s use an example of cash on cash on cash return, which is your pre-tax cash flow (after all operating expenses) divided by the money invested.

For example:

If you put 25% pre-tax on a $100,000 property and your pre-tax cash flow is $5,000, your cash-on-cash return is 20%.

However, if you put 10% down ($10,000) on a $100,000 property, your cash-on-cash return would be 50%!

That is the power of leverage in real estate investing.

If you are an advanced real estate investor, you could use the BRRR Method, which is a cash-out refinancing of your real estate investments which is then used to fund additional real estate projects.

The BRRR Method should only be used by experienced real estate investors.

Passive Income

One of the most attractive features of real estate investing is its ability to generate passive rental income.

Many rental properties can generate a return on investment (ROI) of 7.5% or more, while the median dividend yield for the S&P 500 is 4.23%.

While a 3% risk premium over the S&P 500 may not seem worthwhile, there are other advantages to investing in the real estate market, like tax advantages.

Tax Advantages

Generally speaking, real estate investors can deduct the normal maintenance expenses of their properties plus other large deductions.

Significant tax deductions may include mortgage interest, property taxes, operating expenses, depreciation, and repairs.

Most individuals can deduct expenses for keeping their rental property in good operating condition. For example, certain materials, supplies, repairs, and general maintenance are usually deductible.

Tax deductions can help make a questionable investment property more appealing to real estate investors.

You might also be interested in How To Invest In Real Estate Without Buying Property.

CONS of Real Estate

High Transaction Costs.

Residential real estate closing costs can range from 2% – 6% of the loan amount. In addition, real estate commissions can be between 5 – 6% of the sale price.

If you have a $400,000 real estate investment, you can expect to pay between $8,000 – $24,000 in closing costs and $20,000 – $24,000 in commissions.

Meanwhile, most brokerage companies like M1 Finance have eliminated transaction costs associated with buying and selling stocks.

Limited Liquidity.

Liquidity is how easily and quickly you can buy or sell an asset without affecting its price.

Unlike stocks, you cannot easily buy and sell real estate on the same day. Most real estate transactions can take weeks to months to complete.

However, investing through real estate crowdfunding like Fundrise can offer liquidity options even when buying and selling private real estate.

The ability to quickly convert your assets into cash can is an important differentiator between real estate and stocks.

Time Intensive

Stock investments typically require less time and hands-on management. Once you’ve researched and bought a stock, it doesn’t require the same ongoing time commitment. You can track its performance, make trades, and adjust your portfolio, but this doesn’t typically equate to the hours required for real estate management.

On average, landlords spend between 2 – 10 hours a month on property management activities. Activities can include handling tenant disputes and property repairs, to name a few.

Sure, you can hire a property manager to manage your rental properties, but property managers often charge up to 10% of your monthly rent, significantly impacting profit margins.

This said, the ease and low time commitment of stocks could be a more appealing route for those who can’t commit to the time and effort required in managing real estate properties.

Capital Intensive

Investing in real estate can be expensive. Even if you make a small down payment on a rental property (5% – 10%), a duplex can still cost you upwards of $30,000 -$50,000 upfront. Factor in closing costs (4%) and brokerage fees; you are looking at $80,000 in total.

Not chump change.

Plus, if there are any major repairs that need to be completed, you can expect to shell out another $5,000 – $10,000, on average.

Capital requirements for real estate investments can be cost-prohibitive for many would-be investors.

PROS of Stocks

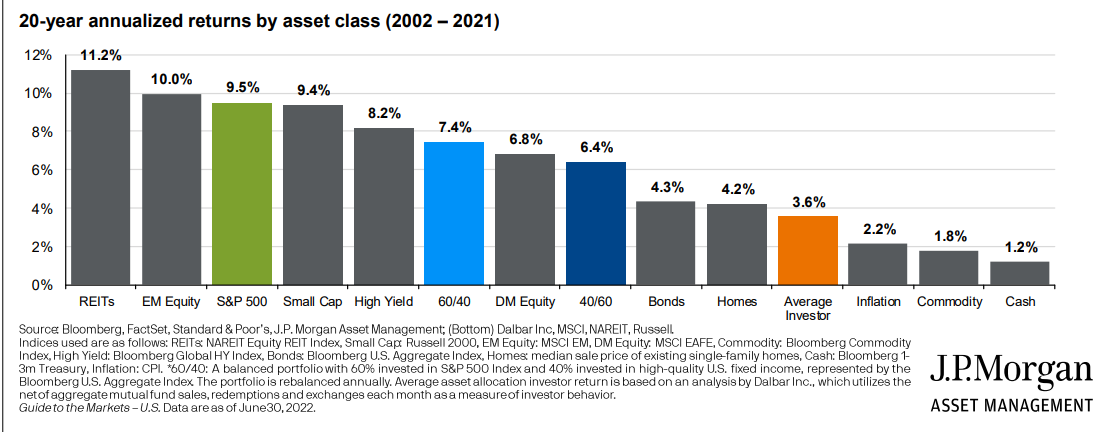

Higher Returns

According to a New York University Study, stocks return about 9.5% yearly, while real estate returns around 4.2%.

The reason for the difference in returns?

Stock market investing is generally seen as a more risky investment, and you are generally better compensated in terms of returns because of that risk.

Liquidity

If you need an investment that allows for quick entry and exit with lower transaction costs, stocks may be more suited to your needs. However, if you’re looking for a long-term investment that can provide a steady income and aren’t concerned with the ability to quickly sell, real estate may be a more fitting option.

Because the stock market has extensive liquidity, transactions are executed faster, and bid-ask spreads are tighter (the price someone is willing to buy vs. the price someone is willing to pay). Unlike real estate, there is no closing period or large brokerage fees, making stocks ideal for short-term and long-term investing.

Real estate is typically a less liquid asset. Selling a property can take months or even longer, depending on market conditions. Furthermore, the costs associated with selling a property, such as broker commissions, closing costs, and potential home repairs, can be quite high.

In addition, the price of a property can be significantly influenced by the local real estate market, which can be unpredictable. This could potentially lead to selling the property at a loss if the market conditions aren’t favorable.

While liquidity is a potential disadvantage of real estate, it’s worth noting that this same illiquidity can also act as a kind of forced savings plan. Once you’ve committed your money to a property, it’s not as easy to withdraw or spend it impulsively. Plus, real estate can provide a steady stream of income through rent, even if the property itself isn’t easy to sell quickly.

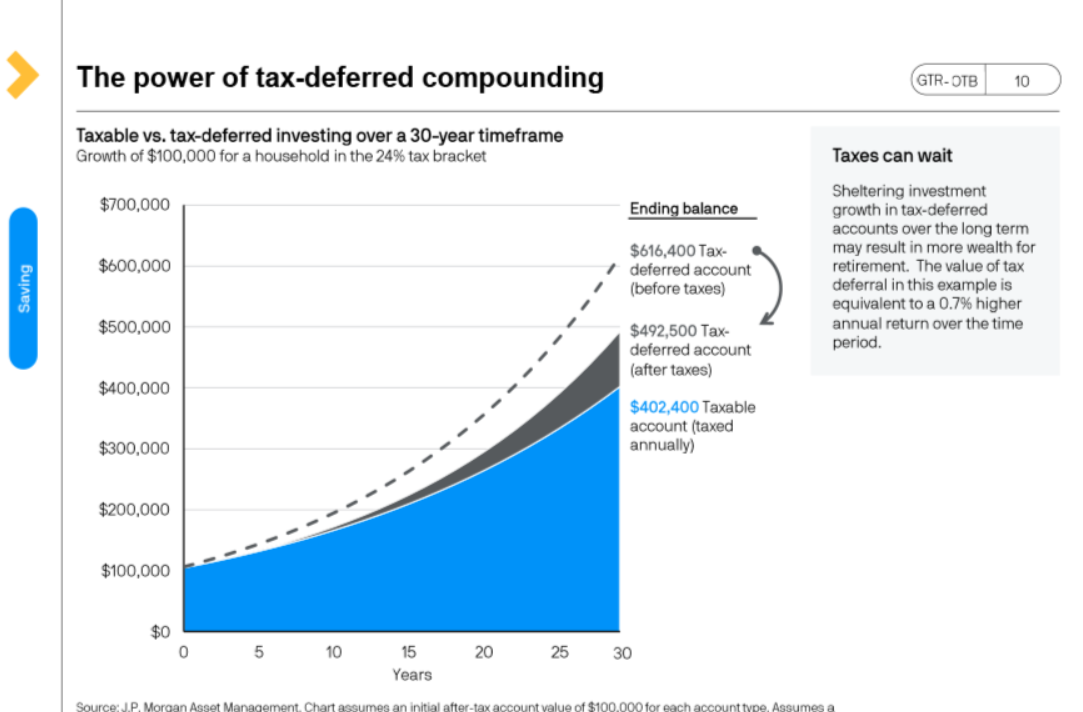

Tax Deferred Investing

Investing in stocks through a tax-deferred account like a 401K or a 403B can be one of the best ways to achieve financial success.

Real estate does not offer many tax-deferred investing opportunities unless you participate in a 1031 Exchange.

401K and 403B contributions are made before taxes and grow tax-deferred. In 2022, you can contribute up to $20,500 in a tax-deferred retirement account.

Taxes are paid once you start withdrawing from your retirement account.

Interestingly, only 14% of Americans maxed-out their tax-deferred retirement accounts, according to Vanguard’s 2022 How America Saves research report, but the number of 401K millionaires is reaching record levels as tax-deferred retirement plans are the 2nd largest source of household wealth creation.

Owning Stocks Less Work.

With stocks, you can simply buy and hold your investment in perpetuity, generate capital appreciation, and earn dividends.

Still, some work is required to manage your investment portfolio, such as portfolio rebalancing and asset allocation.

But unlike real estate, there is no tenant management, no property maintenance, or repairs, freeing you up to spend more time doing things you enjoy.

CONS of Stocks

Volatility

The stock market can be subject to turbulent price swings, both up and down, exasperated by geo-political tensions, monetary policy, global-health-related issues, economic indicators, and even federal legislation.

Since 1980, there have been 51 days when the S&P 500 dropped more than 4% in a single day, as noted by J.P. Morgan Wealth Management Research.

The research also points out that 21 of the 51 days were during the 2008 financial crisis and 9 during 2020.

For most investors, massive stock price swings can be difficult to stomach, causing panic selling and major financial loss. However, the key takeaway is that, even after those periods of extreme volatility, the stock market consistently recovered to all-time highs.

Little Investor Control

Unlike real estate, you have little to no control over the strategic direction of the companies you are investing in. With stocks, you are at the mercy of the CEO and the board of directors, who will drive the company to profitability and subsequent stock price increases.

For some individuals, lack of control can lead to irrational behavior. A recent study showed that 70% of investor underperformance occurred in 10 key periods of market crises.

Is this a coincidence?

Probably not.

When people feel out of control, they can make irrational decisions, commonly known as panic selling.

High Correlation

According to the Wall Street Journal, the average stock has a correlation of 0.58 to the S&P 500. Unlike real estate, stock investments tend to be positively correlated.

Stock market correlation is how financial assets move in relation to each other. Correlation can range from -1 to 1, with a correlation of 1 meaning assets are perfectly correlated.

Why does this matter?

Diversification is an important part of an asset allocation strategy because it can reduce volatility and overall portfolio, according to Guggenheim Investments returns while minimizing risk.

For example, according to Guggenheim Investments, International Equities have a correlation of 0.85 to the S&P 500. This means that if the S&P 500 goes down 10%, international equities are expected to drop 8.5%.

Who Should Invest?

Stock market investing is better for…

- Appreciate a hands-off approach to investing

- Can stomach bouts of market volatility

- Want the ability to easily and quickly buy and sell their investments.

- May not have large amounts of cash to invest

Real estate investing is better for..

- Want complete control of all financial aspects of their investment

- Appreciate the concept of a tangible asset

- Naturally hedged investment

- Can use leverage to safely magnify their returns.

Can You Enjoy the Benefits of Stock and Real Estate?

Definitely.

One of the best ways to get exposure to private real estate while also eliminating the associated maintenance, large capital requirements, and volatility is through a real estate crowdfunding company like Groundfloor.

Groundfloor offers the ability to invest in private real estate with low minimums, no landlord responsibilities, and investments backed by physical collateral. Plus, you can pick and choose the investments you want to fund.

Likewise, you can have the benefits of stock market investing and real estate through a publicly-traded REIT. Publicly-traded REITs offer the liquidity options of individual stocks but with no landlord duties. A popular publicly-traded REIT is Vanguard’s VNQ ETF.

Which Is The Better Investment?

The truth is… there is no right answer.

Real estate investments and stocks have their benefits and shortcomings. Many of the decisions should be made based on your personal financial situation.

But one thing is certain…

If you want to become an investor, a well-diversified investment portfolio should contain a combination of non-correlated assets to minimize risk and reduce volatility.

If you are unsure where to start, consider interviewing a financial advisor through Personal Capital and find out if their advisory services make sense for you.

A well-thought-out financial plan is critical to your financial future for you and your loved ones.