Revolutionize Your Investment Portfolio with eToro: The Social Trading Platform Making Investing Simple and Accessible

Quick Summary:

eToro is a social trading and multi-asset brokerage platform that allows users to trade stocks, exchange-traded funds, currencies, commodities, and cryptocurrencies.

Overall Rating:

PROS

- Low $10 minimum investment

- Copy trading features enables you to replicate top traders.

- $30 refer a friend bonus

CONS

- Withdrawal limitations

- No retirement accounts

What is eToro?

eToro is a social trading and multi-asset brokerage platform that allows users to trade stocks, exchange-traded funds, currencies, commodities, and cryptocurrencies.

The platform is known for its user-friendly interface and unique copy trading feature, allowing users to copy the trades of other successful traders on the platform and share their own trading strategies with others.

The company has more than 25 million users in 140 countries worldwide. In 2022, the company began offering U.S. customers access to stocks and ETFs.

Key Features

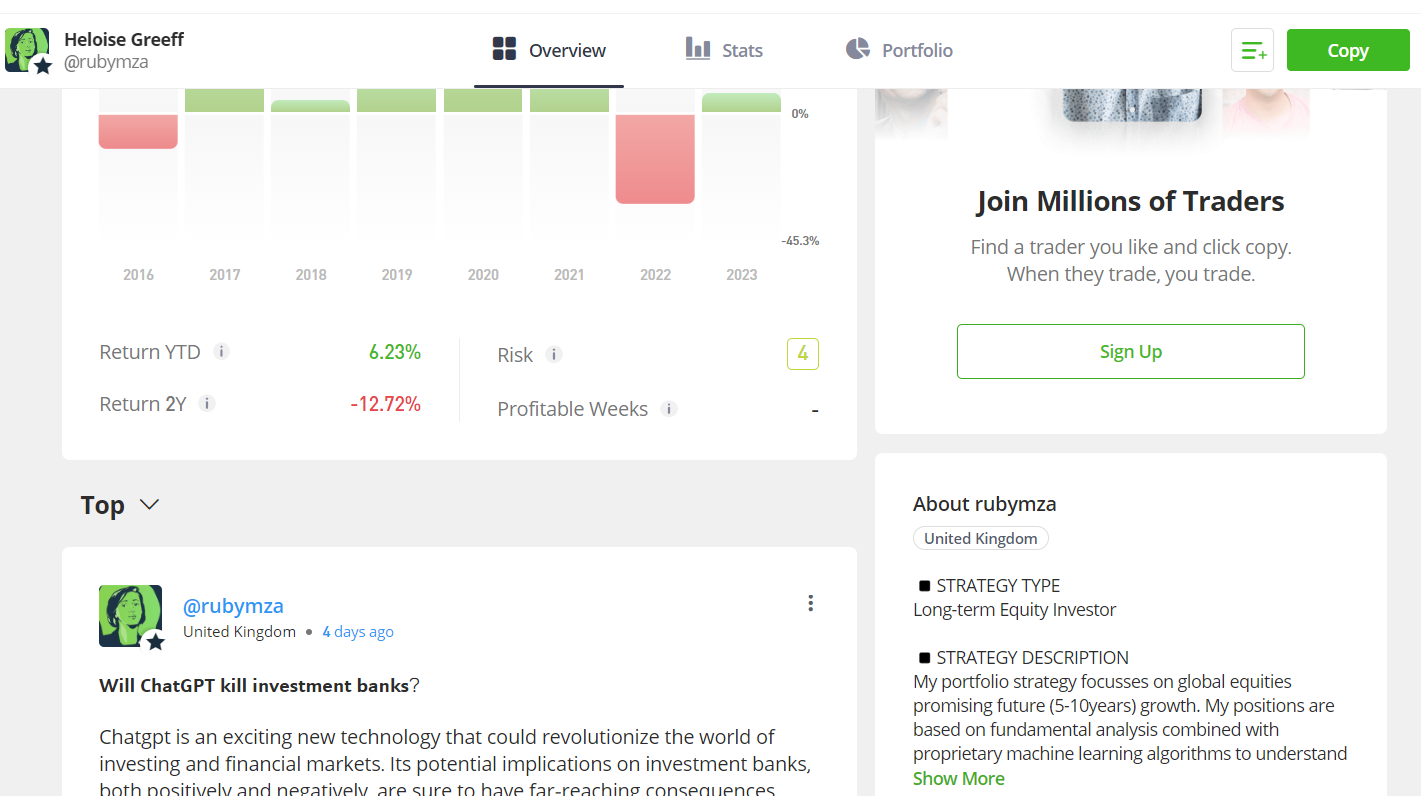

Copy Trading

eToro’s most unique feature, which is not available at any other brokerages, is its copy trading feature. Copy trading allows individuals to copy the trades of other successful traders, which is a great way to invest in various asset classes without needing to do the research and analysis yourself.

Some of the great features of copy trading include the following:

- User-friendly: you can start/stop copying and add/remove funds at any time.

- Automatic: Copied trades are replicated in real-time

- It’s free: No additional charges for using the CopyTrader feature

- Save Time: Manage your portfolio without having to watch the markets constantly

- Leverage Expertise: You are buying assets experienced traders buy themselves, benefiting from their knowledge and expertise.

Before copying a trader, you can view their profile which includes their performance history, investment strategy, portfolio composition, and a feed of their market commentary, including conference calls they may host.

It’s important to note copy trading can be great, but it doesn’t guarantee a profit.

Investment Options

With a minimum investment of just $10, the eToro trading platform supports a variety of investment options for its users, including:

Note: Crypto investors can automatically earn staking rewards, paid monthly through eToro.

In addition, the eToro platform supports several order types, including market orders, limit orders, and stop-loss orders.

- Stocks and ETFs. Users can invest in approximately 2400 individual stocks and ETFs of companies listed on exchanges worldwide.

- Fractional Shares. Invest in fractional shares of 2,000 individual companies.

- Forex Trading. Users can trade currencies on eToro’s platform, like the U.S. dollar, euro, and British pound.

- Commodities. Users can invest in gold, silver, and oil commodities.

- Contract for Difference. eToro is one of the few platforms that offer CFD contracts, which is an agreement between the trader (you) and the broker (eToro) to exchange the difference between the price of an asset at the opening and closing of the trade.

- Cryptocurrencies. Users can buy and sell 24 cryptocurrencies on eToro’s platform, including Bitcoin(BTC), Ethereum(ETH), Dogecoin(DOGE), and Chainlink(LINK).

Fees

Like other popular online brokers, eToro does not charge any fees or commissions for trading stocks or ETFs, or options but does charge a 1% fee for buying and selling cryptocurrencies.

In addition, there are no fees to open an account, but they may charge an inactivity fee if a user remains dormant for an extended period.

- Spreads: eToro charges a 1% fee for cryptocurrency trades, added to the bid-ask spread.

- Inactivity Fee: eToro may charge a fee for inactivity on the account after a certain period.

It’s worth noting that these fees can change over time and vary depending on the region you are based in. It’s important to carefully read and understand the fees before making trades on eToro.

Account Types

eToro offers a wide variety of traditional brokerage accounts but does not offer any retirement or trust accounts.

- Retail trading account: This is the standard account type for individual traders on eToro. It allows users to trade stocks, currencies, commodities, and cryptocurrencies.

- Professional account: This account is reserved for traders who meet certain criteria, like having a large portfolio or significant trading experience. Professional accounts have access to more advanced trading features and higher leverage.

- Corporate account: This account type is for businesses and organizations that want to trade on eToro’s platform.

- Virtual account: This demo account lets users test eToro’s trading platform and strategies with virtual money. A virtual account can be a good way to test out trading strategies.

- It’s worth noting that the account types and their features may vary by country and region, so it’s important to check each account type’s availability and specific features before opening an account with eToro.

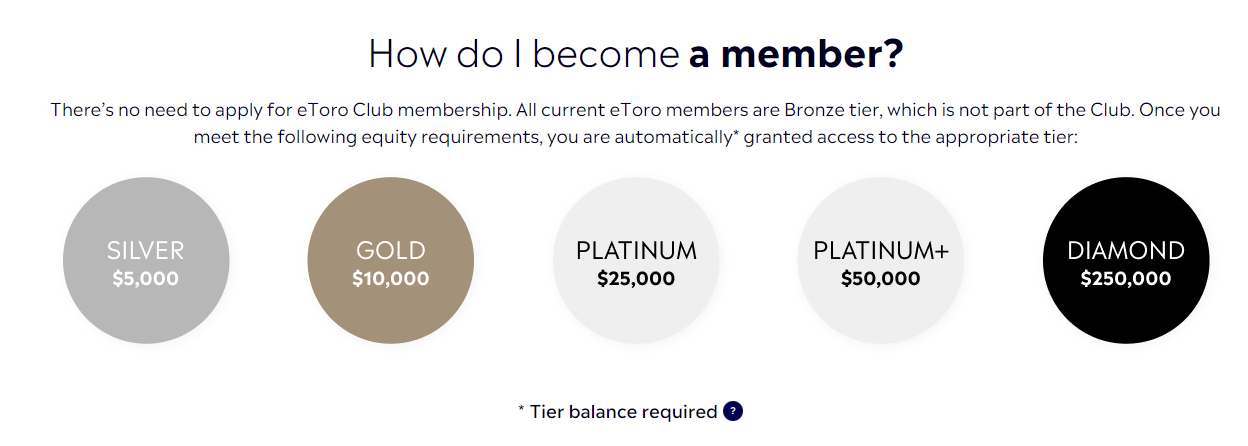

eToro Club

Another unique feature of the eToro platform is its popular investor program which was created to show appreciation to its valued members. Membership is divided into five tiers, each with its own premium perks and exclusive features.

The higher the membership tier, the more offers are available to you.

Noteworthy perks include a Wall Street Journal subscription ($360 annual cost), a crypto fee rebate, an increased staking percentage, and a dedicated account manager.

User Experience

Like any investment platform, there are ways eToro stands out, but also opportunities for improvement.

The Good

The eToro user experience is generally considered to be positive. The platform has a user-friendly interface that is easy to navigate, making it accessible to novice and experienced traders.

Additionally, eToro offers a wide range of research tools, like market analysis, trading signals, and educational resources, which can help users make informed trading decisions.

Customer service also received positive feedback from some users, with some praising the help and support they received when they had issues or questions.

Lastly, the platform is highly-rated; it has a 4.3/5 rating on Trustpilot

eToro also offers a mobile app for trading on the go, available to iOS and Android users.

The Bad

Some users have reported negative experiences with eToro, particularly about customer service and the withdrawal process.

Users complained that customer service is slow to respond or unhelpful when they have had issues or questions.

There are also some complaints about the withdrawal process, with some users reporting delays in receiving their funds or difficulty withdrawing money from their accounts.

Another common complaint is the so-called overnight fee. eToro charges an overnight fee on positions held overnight, which can add up and negatively impact returns, especially for short-term traders.

Lastly, some users reported issues with the platform’s trading execution, experiencing slippage and re-quotes, resulting in unexpected losses.

Pros and Cons

It’s important to carefully consider the pros and cons of any investment platform before committing any funds.

Pros

- Social trading: eToro’s platform allows users to follow and copy the trades of other successful traders, which can be helpful for new traders or those who want to diversify their portfolio.

- Variety of investment options: eToro offers a wide range of investment options, including stocks, currencies, commodities, cryptocurrencies, ETFs, and more.

- User-friendly platform: eToro’s platform is designed to be easy to use and navigate, making it accessible to traders of all experience levels.

Cons

- Fees: eToro charges fees for its services, which can add up over time and eat into a trader’s profits

- Leverage: eToro offers high leverage on its trades, which can be risky for some traders and increases the chance of losses

- Withdrawal limitations: eToro may have some limits on the amount or frequency of withdrawals, which can be inconvenient for some traders

Alternatives to eToro

- Robinhood: A commission-free stock trading platform that offers options trading, crypto trading and cash management services.

- TD Ameritrade: A brokerage firm that offers a wide range of investment options, including stocks, options, ETFs, mutual funds, and more.

All these alternatives have their fees, features, and services. It’s important to compare the platforms and carefully consider which suits your needs and goals as a trader or investor.

Overall Rating | |||

Trading Fees |

|

|

|

Minimum Investment | $10 | $1 | $1 |

Investment Options |

|

|

|

Account Types | Traditional brokerage | Traditional brokerage | Traditional brokerage |

Who Should Use eToro?

eToro is a social trading and multi-asset brokerage platform that may not be suitable for certain types of traders and investors, including:

eToro is a good option for…

- New traders: eToro’s platform is user-friendly and easy to navigate, making it accessible for new traders who are just starting to learn about the markets. Its copy trading feature allows new traders to follow and copy the trades of more experienced traders, which can be a helpful way to learn about the markets and develop a trading strategy.

- Experienced traders: eToro’s platform offers a wide range of investment options and advanced trading tools, making it suitable for experienced traders looking for a platform that offers diverse assets and flexibility.

eToro is not good for…

- Traders who prefer a more advanced trading platform: eToro’s platform is designed to be user-friendly and easy to navigate. However, some traders may prefer a more advanced trading platform with more advanced tools and features.

- Traders who prefer a more diverse range of assets: eToro offers a wide range of assets. However, some traders may be looking for a platform that offers a more diverse range of assets, such as futures and bonds.

Frequently Asked Questions

Is eToro Safe?

Yes, eToro is safe.

eToro is regulated by the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and other entities. eToro follows all SEC and FINRA regulations in the United States.

In addition, cash held in Federal Deposit Insurance Corp. (FDIC)-insured bank accounts for funds up to $250,000.

Security protocols for crypto include offline and online storage of coins, two-factor authentication and state-of-the-art monitoring tools. In addition, no member of the eToro staff can transfer users’ crypto out of storage.

Can I trade on eToro using a mobile device?

Yes, eToro offers a mobile app for iOS and Android devices, allowing users to trade on the go and manage their accounts from their mobile devices.