Battle of the Investing Titans: Webull vs. M1 Finance – Who Will Reign Supreme?

KEY FEATURES | ||

QUICK SUMMARY | M1 Finance is a Robo-advisory platform that offers automated investing and portfolio management. Known for its ease of use, user-friendly interface, and hands-off approach to investing. | Webull is a mobile-first investment platform catering to active traders, offering a wide range of technical and charting tools. |

INVESTMENT OPTIONS |

|

|

FEES | $0 for stocks, ETFs, and options | $0 for stocks, ETFs, and options |

What is M1 Finance?

M1 Finance is an all-in-one personal finance tool platform that offers automated investing and portfolio management, robo-advisory, borrowing, and a checking account all in one place. The company helps investors build a diversified portfolio focused on a long-term strategy through commission-free stock and ETF trading.

The company is known for its ease of use, user-friendly interface, and hands-off approach to investing.

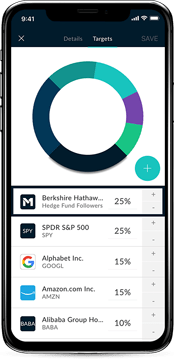

M1 Finance uses a unique “pie” system, where investors can create customized portfolios using a variety of pre-built portfolios or individual stocks and ETFs. The platform also offers automatic portfolio rebalancing and tax-loss harvesting for tax-efficient investing.

You can invest with M1 through a traditional brokerage, retirement, or trust accounts.

In addition to its investment offerings, M1 Finance offers a checking account and a credit card, making it a one-stop shop for personal finance and investing.

Its free checking account offers a high-yield interest rate on cash balances, plus a debit card and ATM access. The M1 Finance credit card offers generous cash-back of up to 10% when you shop at popular retailers.

Read our Full: M1 Finance Review

What is Webull?

Webull is a mobile-first investment platform that offers commission-free trading on stocks, options, and ETFs. The company also offers crypto trading, short selling and access to international markets, complimented by various charting features and technical analysis tools for active traders.

The platform is designed to be intuitive and easy to navigate, making it ideal for experienced and novice investors. Its user-friendly mobile app makes it easy to monitor real-time market data and make trades on the go.

New investors who open a Webull brokerage account can get up to 12 free stocks valued between $3 and $3,000.

Head-to-Head Comparison

Webull and M1 Finance offer investors helpful investing tools and features. Let’s look at 4 key categories and find out how these investment platforms stack against each other.

Investment Options

Winner: Webull

In terms of investment options, Webull is the clear winner over M1 Finance.

Webull offers a wide range of investment options, including stocks, options, ETFs, OTC stocks, and cryptocurrency trading. Users also have access to international markets like the Hong Kong Stock Exchange and can participate in Initial Public Offerings (IPOs) of companies going public soon.

Meanwhile, M1 Finance focuses on a long-term investment strategy and offers fewer investment options than Webull.

Like Webull, M1 Finance also offers stock and ETF trading. However, it’s important to note you can only build a portfolio of securities. You cannot trade individual stocks. However, there is no cryptocurrency, option, Mutual Fund or international stock market trading with M1.

However, M1 Finance does offer automatic dividend reinvestment, a feature not available at Webull, which can help to compound the returns over time.

Lastly, M1 also offers a cash management account: M1 Finance offers a cash management account that provides a debit card and ATM access and a high-yield interest rate on cash balances.

Research, Investing Tools, and Portfolio Optimization

Winner: Tie

Webull and M1 Finance offer helpful research and investing tools, making it difficult to call a winner.

Webull’s tools focus more on the technical and analytical side; they offer advanced charting features and real-time market data.

In contrast, M1 focuses more on portfolio construction and optimization, they provide automatic portfolio rebalancing and tax-loss harvesting, features not available to Webull customers.

Some of the key investing tools offered by Webull include:

Webull Investing Tools

Real-time market data

Webull provides real-time market data and quotes for stocks, options, and ETFs, allowing users to stay up-to-date on the latest market movements.

Advanced charting

The app offers advanced charting features, including more than 50 technical indicators and drawing tools, allowing users to conduct technical analysis on the go.

Webull offers a wide variety of technical analysis tools .

Research Tools

Webull offers a variety of research tools, such as news, earnings reports, and analyst ratings, to help users make informed investment decisions.

Alerts and watchlist

The app allows users to set alerts for specific stocks, options, or ETFs and create watchlists to monitor their favorite securities.

Community

Webull has a community feature where users can share their thoughts and ideas and analyze market trends with other investors.

Paper trading

Webull offers a paper trading feature that allows users to practice and test their strategies without risking real money.

Stock Screener

Webull offers a stock screener that allows users to filter and sort through stocks based on various criteria such as market cap, dividend yield, P/E ratio, and more.

Earnings Calendar

Webull offers an earnings calendar that allows users to track upcoming earnings reports and plan their trades accordingly.

These tools are designed to give users the information they need to make informed investment decisions and help them stay on top of the market.

Meanwhile, because M1 Finance focuses on long-term investing, they offer different tools than Webull. Some of the key investing tools offered by M1 Finance include:

M1 Finance Portfolio Tools

Pies

M1 Finance’s unique “pie” system allows users to create custom portfolios using a variety of pre-built portfolios or individual stocks and ETFs. This system makes it easy for users to diversify their investments and allocate assets according to their investment goals and risk tolerance.

Automatic rebalancing

M1 Finance automatically rebalances users’ portfolios to ensure they remain aligned with their investment goals and risk tolerance. This helps minimize users’ need to constantly monitor and adjust their portfolios.

Tax-loss harvesting

M1 Finance automatically looks for opportunities to harvest tax losses within a user’s portfolio to help reduce their tax bill.

Research tools

M1 Finance offers a variety of research tools and portfolio analytics, such as news and earnings reports, to help users make informed investment decisions, track their portfolios’ performance and identify improvement areas.

Fees

Winner: M1 Finance

Regarding fees, M1 Finance is the winner in this category.

Webull and M1 Finance offer commission-free stock, option, and Exchange Traded Funds (ETF) trading. Both platforms charge account fees for other services.

Still, Webull also charges higher margin trading rates, cryptocurrency mark-up, and short-selling fees, giving M1 Finance a slight edge in the fees category.

Webull Fees

- Cryptocurrency trading: Webull charges a 1.0% mark-up on cryptocurrency trades.

- Margin borrowing: Webull allows users to borrow money from the brokerage to buy securities. The interest rate charged on margin borrowing varies depending on the amount borrowed and the type of security but starts at 9.49%.

- Short Selling: Webull charges a fee for short selling, which is the process of selling a security that you do not own with the expectation that its price will fall. The fee varies depending on the stock and the market conditions.

- Account Transfer Fee: Webull charges a $75 fee for transferring an account from another brokerage

- Inactivity Fee: If a user’s account is inactive for more than 12 months, Webull charges a $10 inactivity fee per month.

M1 Finance Fees

While M1 offers commission-free trading for basic trading functionality, it also charges fees for add-on services. These fees include the following:

- Account transfer fee: M1 Finance charges a $75 fee for transferring an account from another brokerage using the Automated Customer Account Transfer (ACAT) process.

- IRA annual fee: For traditional IRA accounts, M1 Finance charges a $20 annual fee.

- Inactivity fee: If a user’s account is inactive for more than 12 months, M1 Finance charges a $20 inactivity fee per month.

- Margin borrowing: M1 Finance offers margin rates much lower than Webull; 7.75% interest rate, or 6.25% if you are an M1 Plus member.

It’s important to note that M1 Finance’s fees are lower than many other online brokerages, making it an attractive option for cost-conscious investors. Additionally, M1 Finance’s cash management account provides a debit card and ATM access, as well as a high-yield interest rate on cash balances, which can help to offset any fees that may be incurred.

Mobile App

Winner: M1 Finance

Both M1 and Webull offer mobile apps with full functionality. While Webull is designed to be a mobile-first investing app, the ability for M1 Finance to be a one-stop-shop for personal finance, gives M1 the lead in this category.

M1 Finance is a desktop-first service. It also offers a mobile app that provides access to the platform on the go. The mobile app has a similar user-friendly interface as the website and is easy to navigate.

Mobile users can monitor their portfolios, make trades, and access research tools from their mobile devices.

Webull’s mobile-first investing app is designed to be easy to use and navigate. The app is available to iOS and Android device users. It’s a great option for active traders who want to stay connected to the market and make trades on the go.

PROS and CONs

M1 Finance

PROS

- Tax-efficient: M1 Finance allows investors to use tax-loss harvesting, a strategy that can help reduce the amount of taxes they owe on their investments.

- Automated investing: M1 Finance offers a feature called “Smart Investing” that automatically rebalances an investor’s portfolio to keep it in line with their chosen investment strategy.

CONS

- Limited customization options: M1 Finance does not offer many customization options for investors. For example, it does not allow for individual stock picking.

- No fractional shares: M1 Finance does not offer fractional shares, which means that investors must buy whole shares of a stock or ETF.

- Limited Trading Windows: You can only trade during 2 trading windows per day.

Webull

PROS

- Advanced trading tools: Webull offers various advanced trading tools, like real-time market data, technical indicators, and charting tools to help users make informed investment decisions.

- Wide range of investment options: Webull allows investors to trade stocks, options, ETFs, ADRs, and cryptocurrencies.

- Extended trading hours: Webull supports full extended-hours trading, which includes full pre-market (4:00 AM – 9:30 AM ET) and after-hours (4:00 PM – 8:00 PM ET) sessions.

- Free stock trading promotion: New customers can earn up to $3,000 of free stock.

CONS

- Limited account types: Webull only offers individual brokerage accounts, no retirement or trust accounts.

- Limited customer service: Webull customer service is only available during market hours and not 24/7.

Who Should Use These Platforms?

Webull and M1 Finance are both great options for commission-free trading and building a diversified portfolio.

The choice between the two depends on your investment style, goals, and investing experience.

M1 Finance is better for…

Long-term investors who prefer M1’s automated portfolio management and tax-efficient investing strategies.

Webull is better for…

Active traders who want to leverage Webull’s real-time market data and advanced charting features

The Bottom Line

M1 Finance and Webull seem similar at first glance, but each investing platform caters to a different type of investor.

The primary difference between M1 Finance and Webull is that M1 Finance focuses on passive, long-term investing, whereas Webull targets active traders.

In the long run, most individuals end up ahead by adopting a passive investing approach, and given that M1 focuses on this strategy, in the comparison of Webull vs. M1 Finance, M1 Finance is the winner.

You might also be interested in: M1 Finance vs. Robinhood Review