This article will compare Fundrise vs. REITs and help you decide which investment option fits your needs.

Fundrise vs. REITs: Quick Comparison

| Feature |  |  REITs |

|---|---|---|

| Overview | REITs and Funds that are registered with the SEC but do not trade on national stock exchanges. | REITs are registered with the SEC and publicly traded on national stock exchanges. |

| Minimum Investment | $10, but need to invest $5,000 to have access to most features | One share |

| Liquidity | 1% early redemption fee if held for less than 5 years. Does not guarantee liquidity. | Buy and sell anytime |

| Returns | 5.42% across all clients since 2017 | 4.34% across all REITs) since 2017 |

| Fees | 1% Management fee + fees buried in offering circular. | 0.50% on average |

| Overall Stock market correlation | Less correlated | More closely correlated |

| Volatility | Less volatile than publicly-traded REITs | More volatile than Fundrise |

| Management | Usually externally managed, meaning Fundrise is just the platform to list the REITs. | Usually self-advised and self-managed, meaning they own and operate the properties. |

What is Fundrise, and How Does It Work?

Fundrise is a real estate investing platform that offers people an alternative option to investing in real estate projects without the stress and costs of traditional real estate investing.

Accredited and non-accredited investors can invest in commercial real estate assets through Fundrise’s wide variety of eREITs and eFunds with a minimum investment of $10.

The company boasts a wide variety of investment options and strategies, goal-planning features, and a user-friendly investment dashboard.

With Fundrise, you are investing in either Fundrise eREITs or eFunds. eREITs and eFunds comprise a basket of non-traded real estate properties, from multi-family apartments to industrial complexes. The eREITs and eFunds aim to seek a combination of dividend distribution and capital appreciation, depending on the strategy.

When you open an account with Fundrise, they offer a wide range of account levels; Basic accounts require a minimum investment of $10, and the Advanced Portfolio requires a minimum investment of $10,000. The premium level is reserved for accredited investors only, with a minimum investment of $100,000.

Fundrise’s most popular account is its Core Portfolio which has all the options and benefits most investors need. A Core account requires a minimum investment of $5,000.

You can create a customized investment strategy at the Core account level and above. Investors can customize their portfolio by diversifying across a wider variety of funds with specific objectives, such as income, growth, and balanced.

What are REITs, and How Do They Work?

REIT stands for Real Estate Investment Trust. A REIT is a company that owns, operates, or invests in real estate. A REIT can be publicly traded or privately traded.

As long as a company satisfies a long list of requirements set forth by the IRS, it can qualify as a REIT.

A real estate investment trust(REIT) can be publicly traded or non-traded. This article refers to publicly traded REITs that trade on a national stock exchange, like Vanguard’s Real Estate REIT VNQ. A publicly traded REITs price fluctuates daily like a stock.

Requirements to qualify as a REIT include:

● The kinds of assets it owns

● The kind of income it generates

● Who owns it

● How much of its income it distributes to its owners

Some REITs are public, and some REITs are private. REITs can invest in multiple classes of real estate or a single class of real estate, for example, mortgages. The most well-known requirement for REITs is that they are required to distribute 90% of their income to their investors.

There are several tax advantages of qualifying as a REIT, mainly avoiding double taxation: once at the corporate level and then at the individual level – that’s why the REIT distributes 90% of its income to the owners.

Many, but not all, real estate crowdfunding platform investment offerings are structured as a REIT.

Fundrise vs. REITs: How are they the same?

When most people debate whether to invest in Fundrise or REITs, many only consider total returns. However, that only paints a partial picture. Investors should also consider their investment timeline, goals, strategy, and risk tolerance.

In some ways, Fundrise and REITs are similar, but in reality, they are very different. Let’s look below at Fundrise and REITs’ similarities and differences.

Both are passive investments

Fundrise and REITs are passive real estate investments. Both options help you access real estate assets with fewer costs than you would if you had full property ownership and management.

Fundrise and REITs have multiple investment strategies

Fundrise offers a wide range of investment strategies, such as its Growth eREIT, which focuses on commercial real estate, or its Heartland eREIT, which specializes in commercial real estate in the Midwest. Similarly, when you invest in a publicly traded REIT, many have focused investment strategies. For example, some publicly REITs may focus on multi-family apartments like Avalon Bay (ABV), while others specialize in self-storage centers only like Public Storage (PSA).

Low minimum investment

Anyone with a brokerage account can invest in publicly traded REITs for just 1 share. You can also invest with Fundrise for just $10, creating low barriers to investing for REITs and Fundrise.

Investor control

When you invest in publicly traded REITs, they usually focus on a specific strategy such as multi-family or self-storage. And similarly, Fundrise REITs also offer a wide range of strategies and investments depending on your goals.

Federally regulated

Both Fundrise and REITs are regulated by the securities and exchange commission, providing a level of security regardless of the asset you are investing in.

Fundrise vs. REITs: How are they different?

Private real estate has higher returns than publicly-traded REITs

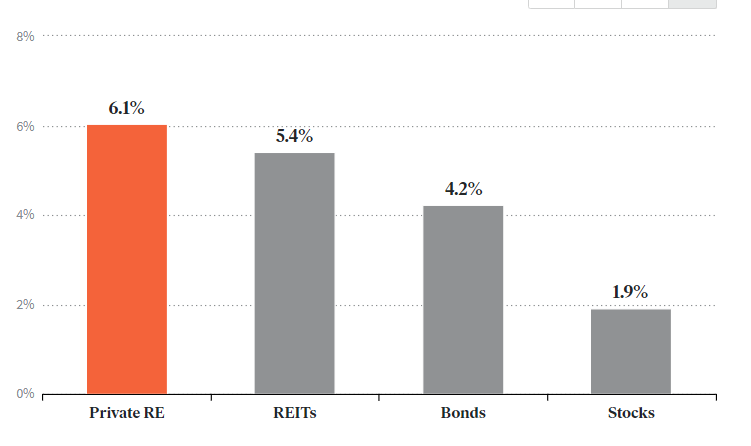

Over the past 20 years, NPI (the index that tracks private real estate performance) has averaged higher returns than other major asset classes, such as publicly-traded REITs, Bonds, and Stocks.

REITs have lower fees than Fundrise

According to the FTSE NAREIT Index, the average fee for REITs is 0.50%. Meanwhile, Fundrise charges an asset management fee of 1%.

REITs are more liquid

Because REITs trade on a stock exchange, you can buy and sell publicly traded REITs anytime. Meanwhile, Fundrise offers limited liquidity options. Fundrise redemption requests prior to holding the investment for five years old are subject to a flat 1% penalty. In addition, Fundrise does not guarantee liquidity, they may stop purchasing shares back if there is extreme market volatility.

Note: Privately held REITs (such as Fundrise) are subject to a liquidity premium. A liquidity premium is a form of extra compensation that is built into the return of an asset that cannot be cashed in easily or quickly. Meaning because you can’t easily buy and sell Fundrise eREITs, there is an economic theory that you should be compensated for that lack of liquidity. And while this is just an economic concept, and reality can play out differently than theory, if you are considering Fundrise vs. REITs, then this is a relevant point.

Fundrise is less volatile

Because Fundrise is not publicly-traded, the NAV of its real estate assets will not fluctuate daily like publicly traded REITs.

Externally managed vs. Internally managed

All eREITs and funds listed on Fundrise’s platform are managed by an external company. Fundrise serves as the platform for individuals to invest through. Meanwhile, most REITs are owned and operated by the company itself. Some individuals view this as a potential conflict of interest as Fundrise may be incentivized to sign-up as many people as possible.

You might be interested in: Best Fundrise Alternatives

PROS and CONS

Fundrise

| PROS | CONS |

|---|---|

| Buy and sell REITs same day | More closely correlated with the stock market |

| Lower fees | More volatility |

| Own and operate the investments | Lower returns |

REITs

| PROS | CONS |

|---|---|

| Historically higher returns than publicly-traded REITs | Limited liquidity |

| Lower correlation to the stock market compared to public REITs | They don’t own and operate the investments |

| Investor tools to pick real estate investments | Higher fees |

Which Is Better: Fundrise or REITs?

It’s not possible to say if investing in Fundrise or REITs is better. Both investments have their benefits and drawbacks. If you are interested in real estate investing but are unsure where, how to start or what real estate project to invest in, then Fundrise is a better option for you.

Fundrise makes the rather complicated world of real estate investing easy to understand for everyday individuals like you and me. Meanwhile, if you are an experienced investor who doesn’t need any investor tools or guidance, then investing in REITs through your brokerage is probably the better option for you.

That said…

There are plenty of people to rave about Fundrise, and just as many individuals who think investing in publicly-traded REITs is the only way to get exposure to real estate investing.

Fundrise is better for…

Fundrise is best for individuals who want to invest in real estate but are unsure where, how to start, or what to invest in. Fundrise can guide you in creating an investment portfolio to meet your goals and needs.

REITs are better for…

Experienced investors who want do not need any guidance in creating their real estate portfolio. Furthermore, if you are an investor who doesn’t want to lock up their money for at least 1 year, then REIT investing is better for you.