Fundrise vs. DiversyFund Showdown: Uncover the Ultimate Real Estate Crowdfunding Champion

DiversyFund vs Fundrise: At A Glance

| Feature |  | |

|---|---|---|

| Minimum Investment: | $500 | $10 |

| Fees | 2% Asset Management Fee + other fees | 1%/yr of AUM |

| Returns | Not listed | 11.58% net of all fees across all clients 21 consecutive quarters of positive returns |

| Investment Type | Multifamily real estate Public Non-Traded REITs | Multifamily, Commercial REITs and funds, private equity |

| Retirement Account Investing? | No | Yes |

| Dividend Reinvesting | No | Yes |

| Open To | Accredited & Non-Accredited Investors | Accredited & Non-Accredited Investors |

| Liquidity Options | No | Yes |

| Mobile App | No | Yes |

| Investor Goals & Planning Tools | No | Yes |

| Best For | Individuals interested in real estate investing with little money and a semi-guided approach. | Investors who are interested in a long-term strategy with a value-add approach. |

| Current Promotions | None | $25-50 share referral bonus |

What Is DiversyFund?

DiversyFund is a real estate crowdfunding platform that invests in multifamily real estate through a non-traded REIT (Real Estate Investment Trust). The REIT currently manages 12 multifamily assets across 6 states with a current market value of $175 million.

DiversyFund’s goal is to make real estate investing available to all investors, not just the ultra-wealthy and is open to accredited and non-accredited investors with a minimum investment of $500.

Founded in 2016 by Craig Cecilio and Alan Lewis, the DiversyFund platform boasts 28,000 investors and is headquartered in beautiful San Diego, California.

GO DEEPER: Read our complete Diversyfund Review

What Is Fundrise?

Established in 2010, Fundrise is the oldest real estate crowdfunding platform. Fundrise offers people an alternative option to investing in real estate without the stress and costs of traditional real estate investing.

Fundrise boasts a wide variety of investment options and strategies in addition to goal-planning features and a user-friendly investment dashboard.

More than 300,000 people use Fundrise today and have invested over $ 7 billion in properties throughout the U.S. Fundrise has had 21 consecutive quarters of returns, averaging 22.99% in 2021.

You can start investing in Fundrise’s Starter Portfolio with just $10.

Fundrise is based in Washington, DC, and was founded by Ben Miller, who has over 20 years of experience in the real estate industry.

GO DEEPER: Read our complete Fundrise Review

How Does Investing With DiversyFund Work?

Investing with DiversyFund involves investing in a real estate investment trust (REIT) that is focused on multifamily and single-asset investment properties. Here’s how it works:

1. Sign up

The first step in investing with DiversyFund is to sign up for an account on their website. You will need to provide some basic personal information, including your name, address, and social security number. It takes about 5 – 8 days to fully open your account.

2. Fund your account

Before you can invest in one of DiversyFund’s offerings, you will need to fund your account. You can do this by linking a bank account and transferring funds electronically.

Accredited and non-accredited investors can invest with DiversyFund with a minimum investment of $500.

3. Choose your investment

Once you have signed up and funded your account, you can choose to invest in one of DiversyFund’s investment offerings. DiversyFund currently offers two investment options: the Growth REIT II, which is open to all investors and Single Asset Offerings, only open to accredited investors.

4. Receive updates

As an investor, you will receive regular updates on the performance of your investment, including quarterly financial reports, property updates, and other relevant information.

Receive dividends: DiversyFund’s REITs pay dividends to their investors on a quarterly basis. The amount of the dividend will depend on the performance of the REIT and the amount of money that you have invested.

5. The REIT sells properties

DiversyFund’s REITs acquire and manage multifamily real estate properties, and over time, they may sell properties that are no longer performing well. When a property is sold, the profits are distributed to the investors in the form of capital gains.

6. Withdraw your funds

If you need to withdraw your funds, you can do so at any time. However, there may be restrictions on when you can withdraw your funds, and there may be fees associated with early withdrawals.

Overall, investing with DiversyFund is a relatively simple process that allows investors to earn passive income from real estate investments. However, it’s important to remember that all investments come with some level of risk, and investors should carefully evaluate each investment opportunity before investing their money.

How Does Investing With Fundrise Work?

When you invest with Fundrise, you are investing in either Fundrise eREITs or eFunds. Fundrise is available to non-accredited and accredited investors alike with a minimum investment of just $10.

eREITs and eFunds comprise a basket of non-traded real estate properties, from multifamily apartments to industrial complexes.

The eREITs and eFunds aim to seek a combination of dividend distribution and capital appreciation, depending on the strategy.

When you open an account with Fundrise, they offer a wide range of account levels; Basic accounts require a minimum investment of $10, to its Advanced Portfolio which requires a minimum investment of $10,000. The premium level is reserved for accredited investors only.

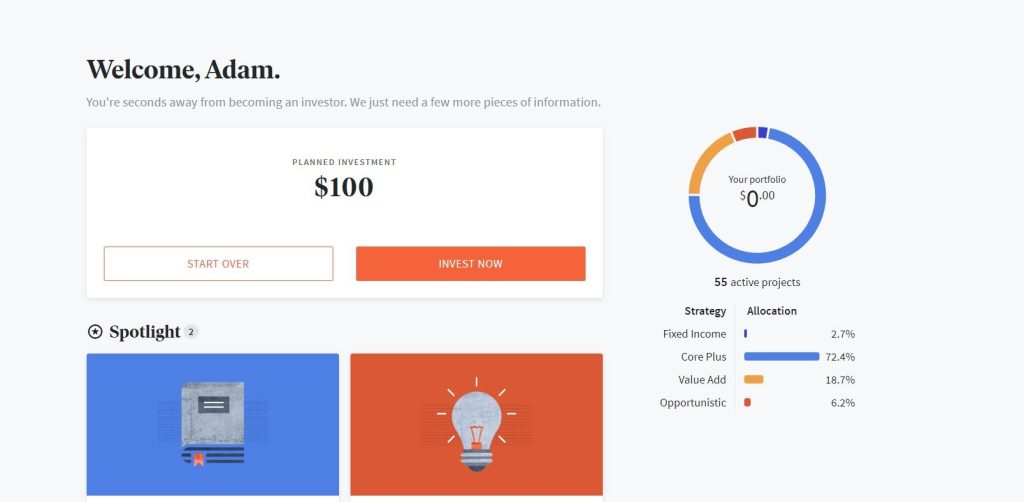

Once you open a Fundrise account, you can view and manage your investments from one easy-to-use dashboard.

DiversyFund Key Features

- They own and manage all their properties. Many real estate crowdfunding platforms, commonly referred to as the deal’s sponsor, serve as a middleman, connecting investors with developers. DiversyFund manages the entire process in-house. For some investors, this can provide peace of mind, and illustrates the company is well positioned and manage an end-to-end real investing deal.

- $500 Minimum Investment. You can start investing with DiversyFund with just $500. Many other real estate crowdfunding platforms require a minimum investment of $5000, so this is certainly in the lower range.

- Skin-in-the-Game. This means the fund managers (DiversyFund) also invested their own money into the investments offered to its clients. This shows that the sponsor has a vested interest in making the deals profitable as they stand to make or lose money too.

- Focused Value-Add Investment Strategy. The fund only focuses solely on a value-add investment strategy that targets an IRR of 10% – 20%. This means they acquire and renovate properties in order to increase value. Given that they only manage 1 type of strategy this allows the company to become experts at value-add strategies, which in the long run will be beneficial for their investors.

- Preferred Equity Returns. DiversyFund investments are qualified as a preferred equity class of shares in the Capital Stack. This means preferred equity investors are given preference relative to common equity investors as it relates to cash flow distribution.

In the case of DiversyFund, it is split into 2 parts. First, investors first receive a 7% return on their investment, then the sponsor is entitled to a ‘catch-up’ return of 53.85% of the preferred returns, secondly, Diversyfund receives 35% of the remaining profits, and investors receive 65%.

Preferred Equity Example:

Total Return: 20%

Total Paid to Investors: 12.99%

Total Paid to DiversyFund: 7%

Preferred Return Paid To Investors: 7%

Catch-Up Return Paid To DiversyFund: 3.77% (53.85% * 7%)

Remaining Profits to Split: 9.23% (20% – 7%- 3.77%)

Remaining Profit Paid to Investors: 5.99% (9.23% * 65%)

Remaining Profit Paid to DiversyFund: 3.23% (9.23% *3 5%)

Fundrise Key Features

- $10 Minimum Investment. You can open an account and start investing in real estate with just $10.

- Early Redemption Option. If investors want to redeem their shares of the eREITs or eFund, they can place a redemption request at any time. However, any eREIT or eFund redemptions processed before an investment is five years old is subject to a flat 1% penalty.

- Dividend Reinvestment. If you enable dividend reinvestment, dividends earned are automatically reinvested on a quarterly basis according to your investment plan.

- Create and Manage Investor Goals. This feature allows you to invest with a defined goal in mind so that you can track your progress towards achieving your defined goals. Investor goals are only useful if your investment horizon is 5 years or longer.

Common goals include saving for a large purchase or retirement. The Investor goals tool is expected to give you a sense of how your portfolio could grow over time through continued investment, appreciation, and dividend/distribution income.

Once your goal is set, the goal tracker will monitor if you are on track, needs attention, or are off-track, and then guide you towards actions to make adjustments to help you meet your goal.

Investor Goals is available to all taxable accounts beginning at the Starter account level.

- Automated Investing. You can schedule automatic investing to your Fundrise portfolio, at any time, with $10 increments. Auto-investments are allocated according to your chosen plan, and Fundrise may offer new investments to invest in automatically as they arise.

- 1%/yr Fee. Fundrise charges a yearly asset management fee of 0.85% plus a 0.15% advisory fee, so 1%/yr for AUM. All dividends are net of fees. So for every $1,000 invested, you will pay $10 in fees.

Fundrise does not charge any transaction fees, sales commissions, or additional fees for enabling features on your accounts, such as dividend reinvestment or auto-invest.

- 21 Consecutive Quarters of Positive Returns. Since its inception, Fundrise delivered 21 consecutive quarters of positive returns with a net 11.58% return across all clients since inception. Their best quarter returned 9.40% and their worst quarter was 1.15%.

- Multiple Account Levels. The Fundrise platform consists of five levels of accounts with varying minimum balance requirements. Depending on the level of account opened, you will have access to different investment options.

Fundrise’s most affordable option is its ‘Starter’ portfolio. This low-cost package starts at $10. The portfolio includes access to Fundrise’s registered products, dividend reinvestment, and auto investing.

If you open a ‘Starter’ portfolio, you can invest in the Income Fund, which focuses on cash flow generation, or the Flagship Fund, which focuses on income and capital appreciation.

However, the Starter portfolio does not have IRA access or other advanced functionality. For $1,000, you can upgrade your account to the Basic Plan. With the Basic Plan, you can define your investment goals, open a taxable IRA, and invest in the Fundrise iPO.

Neither the Starter nor Basic plans grant access to Fundrise’s non-registered investment programs. After that, there are 3 higher-level plans which include: Core, Advanced, and Premium. These plans have a higher minimum balance, but also come with more advanced features including additional investment options such as an Opportunity Zone Fund.

Head-to-Head Comparison

In this Diversyfund vs. Fundrise comparison, we take a look at 6 key functions of these real estate crowdfunding platforms and see how they stack up against each other.

Investment Options

Winner: Fundrise

DiversyFund and Fundrise both offer real estate investment opportunities, but the types of investments available differ between the two platforms.

DiversyFund has one investment option for its investors. Alternatively, Fundrise offers various eREITs and eFunds with varying investment strategies and goals, ranging from capital appreciation to income generation.

DiversyFund Investment Options:

Diversy Growth REIT II is their only investment option. The Growth REIT II invests in multifamily apartments and applies a value-add strategy method. After properties are acquired, renovations are performed to increase value, which, in turn, allows for increased rents, and ultimately an increase in value during the sale process.

Fundrise Investment Options:

Fundrise offers multiple investment options, including eREITs, eFunds, and a Starter Portfolio. The eREITs are similar to DiversyFund’s REITs, but Fundrise also offers eFunds that focus on specific types of real estate projects, such as commercial properties or single-family homes. The Starter Portfolio is a diversified portfolio of eREITs and eFunds that is designed for first-time investors.

Has 11 active eREITs and 2 eFunds. eREIT strategies span from income generation to Midwest Region strategies. eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy. Fundrise typically allocates its clients’ portfolios to a combination of eREITs, calibrating each client to specified objectives and risk tolerance.

The eFunds are comprised of an Income Real Estate Fund, whose main objective is income distribution and currently has a 6.5% distribution rate.

Their other fund is The Flagship Real Estate Fund which has an investment objective to generate income, while also seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets. The Flagship Real Estate Fund currently has a 0.75% distribution rate.

Overall, Fundrise offers a greater variety of investment options than DiversyFund, which may be appealing to investors who want more control over their investments. However, DiversyFund’s focus on multifamily properties may be attractive to investors who want exposure to a specific type of real estate asset.

Early Redemption Options

Winner: Fundrise

DiversyFund does not offer any redemption features. On the other hand, Fundrise offers liquidity options with a handful of caveats. Let’s look below.

DiversyFund: Diversyfund does not offer any early redemption features if you wish to exit your investment early. If you cannot afford to lock up your money for 5 years, DiversyFund is not a great option for you.

Fundrise: If investors want to redeem their shares for the eREITs or eFund, they can place a redemption request at any time.

However, after a request is submitted, Fundrise typically processes the requests quarterly for the eREITs, and monthly for the eFunds after a minimum 60-day waiting period.

Any eREIT or eFund redemptions processed before an investment is five years old will be subject to a flat 1% penalty. After five years, investors can request to redeem their shares at any time for their full value, with no penalty applied.

It’s important to note that while under normal market conditions, Fundrise seeks to provide investors with liquidity through the redemption plan, during a financial crisis, investors should expect us to pause the redemption plan long enough to allow enough time for whatever events may unfold.

Note: If you invest in the Fundrise Income Fund, redemptions are allowed quarterly with no fees.

Fees

Winner: Fundrise

DiversyFund and Fundrise charge fees for managing their investment products, but the fee structure and amount vary between the two platforms.

DiversyFund Fees

DiversyFund charges an asset management fee of 0.5% per year, which is deducted from the net asset value of the REIT. In addition, there is a redemption fee of 1% if investors redeem their shares within the first five years of investing.

Fundrise Fees

Fundrise charges a management fee of 1.00% per year, depending on the investment option. In addition, there is a one-time upfront fee of 0.15% to 0.50% for certain investments. Fundrise also charges a redemption fee of 0% to 3% if investors redeem their shares within the first three years of investing.

So, for every $1,000 invested with Fundrise, you will pay $10 in fees.

Fundrise does not charge any transaction fees, sales commissions, or additional fees for enabling features on your accounts, such as dividend reinvestment or auto-invest.

Overall, Fundrise charges lower management fees than Fundrise, but it also charges a redemption fee. Fundrise’s management fees are higher, but they do not charge an upfront fee for most investments, and the redemption fee is lower than DiversyFund’s for certain investment options

Returns

Winner: Fundrise

Comparing returns can be nuanced given different investment strategies and goals. However, Fundrise has returned 21 consecutive quarters of returns, and given DiversyFund’s short operating history and 5-year holding strategy, there’s not much to compare, so Fundrise takes the W here.

DiversyFund Returns

Returns are only realized when an asset is sold. Returns come from both dividends and appreciation realized at the time of sale. Given DiversyFund’s limited operating history, and a 5-year holding term, there isn’t much historical return data, for comparison purposes. DiversyFund’s website does state it targets an Internal Rate of Return (IRR) of 10% – 20%, however, there’s no guarantee that it will hit those targets.

From their website, the below returns are listed:

- 2017: Average annualized returns of 18%.

- 2018: Average annualized returns of 17.3%

However, the returns listed above are from projects that materialized before the Growth REIT started, but I suppose they are listing them to illustrate their returns capabilities.

- In 2019, REIT investors saw a 5% dividend yield and DiversyFund expects this to increase as they finalize the renovation process and increase rents. However, dividends are automatically reinvested and investors only receive returns at the asset sale.

Fundrise Returns

From 2017 – 2021, Fundrise returned an average annualized return of 11.58%, net of fees across all clients. Compared to all public REITs, which returned 13.4% and 19.21% for the S&P 500, so Fundrise slightly underperformed the market.

It’s important to note that your total returns could vary depending on your chosen plan and investment objective.

Fundrise has had 21 consecutive quarters of positive returns, with their best quarter returning 9.40% and their worst quarter being 1.15%.

Both the S&P500 and all public REITs had only 17 consecutive positive returns, with their best quarters returning 20.54%/16.70% and worst quarters returning -19.60%/-25.42%, respectively.

| Year | Fundrise Returns Across All Investors |

|---|---|

| 2022 Q1 | 3.49% |

| 2021 | 22.99% |

| 2020 | 7.31% |

| 2019 | 9.16% |

| 2018 | 8.81% |

| 2017 | 10.63% |

Account Options

Winner: Fundrise

The types of accounts offered by DiversyFund and Fundrise are quite similar, except Fundrise offers Individual Retirement Account (IRA) for basic portfolios and up. This difference gives Fundrise a slight edge.

DiversyFund offers the following types of accounts:

- Individual

- Joint

- Trust

- Entity

Where they fall short is a lack of a retirement account investing through an IRA, which can offer significant tax advantages.

Fundrise offers these types of accounts:

- IRA (Not available with Fundrise)

- Individual

- Joint

- Trust

- Entity

User Experience

Winner: Fundrise

iversyFund and Fundrise both offer online investment platforms that are designed to make investing in real estate accessible to a wide range of investors. Here are some of the key differences in user experience between the two platforms:

DiversyFund User Experience:

DiversyFund’s platform is relatively simple and straightforward, with a focus on providing clear information about the REITs and investment process. The platform offers a dashboard where investors can view their investments and account information, as well as access educational resources and support.

Fundrise User Experience:

Fundrise’s platform is more comprehensive and includes a variety of tools and resources to help investors manage their portfolios. In addition to a dashboard for viewing investments and account information, Fundrise offers a mobile app, investment planning tools, and access to a team of financial advisors. Fundrise also provides regular updates and insights on the real estate market and investment performance.

Overall, Fundrise’s platform offers a more robust and engaging user experience than DiversyFund’s platform. However, some investors may prefer the simplicity and transparency of DiversyFund’s platform. Ultimately, the best platform for a particular investor will depend on their individual preferences and investment goals.

PROS And CONS

DiversyFund

PROS

- Low minimum investment ($500)

- Strong historical performance

- Fund managers have skin in the game

CONS

- No early redemption features

- No cash distributions until asset sales start

- Limited investment options

Fundrise

PROS

- Wide Range of Investment Options

- $10 minimum investment

- Investor goal & planning tools

- Early redemption features

- Mobile App

CONS

- Early redemption fees

- A tiered account makes not all features available to all investors

The Bottom Line

Fundrise offers more robust features that will be more appealing to most people and makes it the winner in my book.

Alternatively, I don’t think the DiversyFund platform is bad, but I think Fundrise has more bells and whistles. The DiversyFund focuses on a very particular subset of real estate investors who are interested in a long-term strategy with automatic dividend reinvesting and no liquidity options, so it only appeals to a select subset of real estate investors.