I tried some of the most popular stock-picking services – here’s what I discovered.

5 Best Stock Picking Services

- Best Overall: Alpha Picks by Seeking Alpha

- Best for Buy and Hold: Motley Fool Stock Advisor

- Best for Momentum Trading: CNBC Investing Club

- Best for Swing Trading: Mindful Trader

- Best for Short Term Trading: Action Alerts Plus

1. Best Overall: Alpha Picks by Seeking Alpha

- Best For: Buy and Hold investors

- Overview: Alpha Picks is Seeking Alpha’s in-house investing group. Alpha Picks subscribers get 2 monthly stock picks selected by their in-house investment team run by Steven Cress, a former Hedge Fund manager

- Returns: Alpha Picks has returned 124%, vs. 38%, outperforming the S&P 500 three-fold since inception in 2022(returns as of February 2024).

- Price: $41/mo ($499/year)

- Current Promotions: None listed

- Pros: Stock market outperformance, investing community engagement

- Cons: Limited track record, requires familiarity with the Seeking Alpha Rating system, No skin in the game

Note: Alpha Picks is a stand-alone investing service from Seeking Alpha. You do not get a Seeking Alpha subscription with an Alpha Picks subscription – they are two different services.

When I signed up for Alpha Picks, I was a bit skeptical, given its limited track record. However, the service has continued to outperform the market, so I can’t complain.

or read our complete Alpha Picks Review.

2. Best for Buy and Hold: Motley Fool Stock Advisor

- Best For: Long-term investors

- Overview: Stock Advisor offers monthly stock picks from the company’s co-founders, Tom and David Gardner, who each manage separate teams of analysts. The service recommends stocks from established companies with proven track records and strong growth potential. Stock Advisor also advises when to sell, a feature differentiating it from many other stock-picking services.

- Pros: 2 stock picks per month, High long-term returns, stock research reports

- Cons: Constant upselling, limited portfolio analysis

- Returns: +639% since its inception in 2002

- Price: $99/year

- Current Promotions: 50% Off Full Price ($199/year)

At $99/year, it’s hard to beat the pricing. I’ve used Motley Fool for a while, and while none of their recent investments have been home runs, it’s a good subscription to keep in your investing stack.

or read our complete Motley Fool Review.

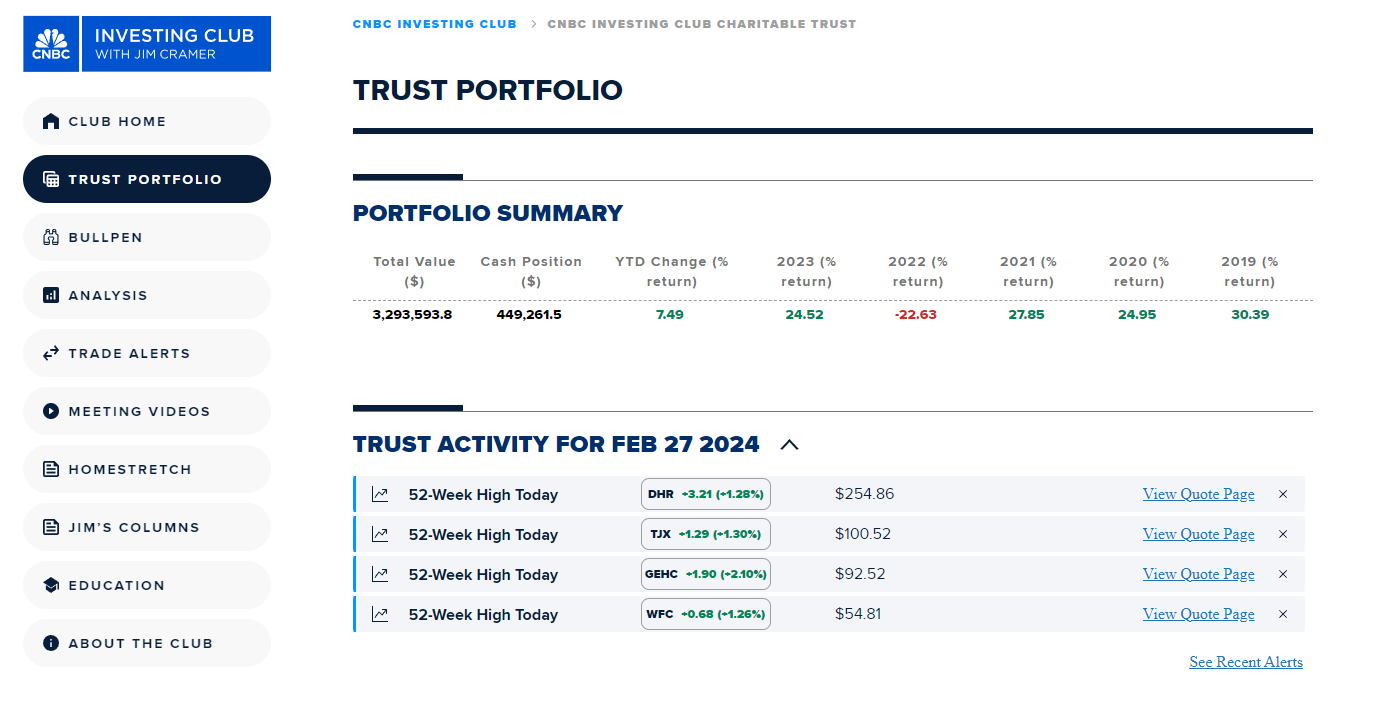

3. Best for Momentum-Oriented Investors: CNBC Investing Club with Jim Cramer

- Best For: Active investors, momentum-oriented investors

- Overview: The CNBC Investing Club is a subscription-based investing service that provides stock picks, portfolio analysis, and market news from Jim Cramer and his team. Jim created the Investing Club to help all investors build long-term wealth in the stock market, and the CNBC Investing Club is now the official home of Jim Cramer’s Charitable Trust. The investing club is the only place to view the charitable Trust’s stock picks. It’s not available on Mad Money or any other investing platform related to CNBC.

- Returns: 17.06% over the past 5 years (Since 2019).

- Price: $49.99/mo

- Current Promotions: 20% off Yearly Subscription

The investing club’s performance is largely on par with the S&P500’s returns over the same period. While this isn’t necessarily bad, I wouldn’t expect to see any really unique picks.

or read our complete CNBC Investing Club Review.

4. Best for Swing Trading: Mindful Trader

- Best For: Swing traders

- Overview: Mindful Trader is a stock and option-picking alert service focusing on swing trading. Swing trading is a trading style that generates profits from small to medium price movement over a short period – typically a week or less. Mindful Trader was built on the premise that using rigorously back-tested statistical strategies can generate wealth through stocks, options, and futures trading. The platform was founded and built in 2020 by Eric Ferguson, who has over 20 years of stock trading experience. He spent over 4 years and $200,000 of his own money developing the statistical tools used by Mindful Trader. He has a degree in Economics from Stanford University – his pedigree is legit.

- Returns: Varies depending on investment strategy

- Price: $49.99/month, no long-term commitment

I used Mindful Trader for a very short time frame and found the constant trading somewhat difficult to follow and the website cumbersome. I’m more of a buy-and-hold investor, not a swing trader.

Read our complete Mindful Trader Review.

5. Best for Short Term Trading: Action Alerts Plus

- Best For: Short-term traders

- Overview: Action Alerts PLUS is a subscription-based stock-picking service offered by TheStreet.com. This service was founded by financial analyst and commentator Jim Cramer, known for his work on CNBC’s “Mad Money,” along with a team of research analysts.

- Price: $12.50 – $29.99/mo

Read our complete Action Alerts Plus Review.

What are Stock Picking Services?

Stock picking services are platforms that offer recommendations on which stocks to buy and sell. They’re designed for investors who may not have the time or expertise to conduct thorough stock research on their own.

What to Look for in Stock Picking Services

When evaluating stock-picking services, it’s important to consider several key factors to ensure you choose a service that aligns with your investment goals and style.

- Track Record: Check the service’s historical performance. A consistent record of successful stock picks is a good indicator of reliability.

- Investment Philosophy: Ensure their approach matches your investment strategy, whether it’s long-term growth, value investing, or short-term trading.

- Transparency: A reputable service should be transparent about their successes and failures, providing detailed analysis to support their picks.

- Cost vs. Value: Assess the subscription cost relative to the value you receive. High fees do not always equate to high returns.

- Quality of Analysis: Look for services that provide in-depth research and analysis rather than just stock tips. Understanding the ‘why’ behind a pick is crucial.

- Diversity of Picks: A good service should offer a range of picks across various sectors and industries to help diversify your portfolio.

- Educational Resources: Especially beneficial for new investors, educational content can enhance your understanding of the market.

- Frequency of Picks: Ensure the frequency of stock recommendations aligns with your desired level of market activity.

Even the best stock picking services don’t guarantee profits, and investing always involves risk. It’s important to use these services as one of many tools in your investment strategy and not rely solely on them for decision-making.

Conducting your own research and due diligence is always crucial in investing.

Stock Picking Strategies

- Value Investing: This strategy involves looking for undervalued stocks that are priced below their intrinsic value. Investors using this strategy believe the market will eventually recognize and correct the undervaluation.

- Growth Investing: Growth investors seek companies with strong potential for future growth. These stocks may not pay dividends but are expected to grow at an above-average rate compared to other companies in the market.

- Income Investing: Focused on generating steady income, this strategy involves buying stocks with high dividend yields. It’s popular among retirees and those seeking regular income.

- Momentum Investing: Momentum investors look for stocks that are experiencing an upward price trend. They buy these stocks and hold them until the trend begins to reverse.

- Index Investing: While not strictly stock picking, index investing involves buying index funds that track a market index, offering diversification and reflecting the market’s performance.

- Technical Analysis: This strategy uses statistical trends gathered from trading activity, such as price movement and volume

Read more: How to Research Stocks.

Benefits of Stock Picking Services

Stock-picking services offer several benefits, particularly for individual investors who may not have the time or resources to conduct extensive market research.

- Expert Analysis: Stockpicking services often have experienced analysts who provide expert insights, making it easier for investors to make informed decisions.

- Time-Saving: Doing thorough stock research can be time-consuming. These services save time by providing ready-to-use investment suggestions.

- Educational Resources: Many services offer educational content that can help investors learn more about the stock market, investment strategies, and financial analysis.

- Diversification: Good stock picking services offer recommendations across various sectors and industries, helping investors diversify their portfolios.

- Access to Specialized Knowledge: These services often have access to sophisticated tools and data that individual investors may not have, providing an edge in the market.

- Risk Management: Some services provide guidance on managing risk, including how to diversify and when to exit positions.

- Performance Tracking: Many stock picking services offer tools to track the performance of their recommendations, making it easier for investors to evaluate their investment choices.

- Community and Support: Some services create a community of investors where ideas and strategies can be shared, offering support and a sense of belonging.

Our Review Methodology

Investing in the right financial products is crucial for achieving your financial goals. That’s why our review methodology is designed to give you a comprehensive understanding of various investing platforms and tools. Here’s a breakdown of what we focus on:

Tools and Features

We dig deep into the suite of tools that each platform offers. Whether it’s automated investment features, tax optimization, or specialized charting tools, we evaluate how these features contribute to smarter investing decisions. We ask questions like:

- What is its main offering, and how does it compare to its peers?

- How effective are the risk assessment tools?

- Are there any value-added services like educational content?

Price and Value

Price matters, especially when it comes to investing, where every penny counts. We analyze:

- Subscription fees

- Hidden Charges

- Price compared to the overall value received

We’ll let you know if the platform gives you the most bang for your buck.

Ease of Use

User experience can make or break an investment platform. We assess:

- Interface Design – Is it intuitive and easy to use?

- Mobile app availability and functionality

- Customer Support – where applicable.

Nobody wants to navigate a clunky interface when dealing with their hard-earned money.

Stock Breakdown

Good investing is rooted in great research. We examine:

- The quality of stock analysis tools

- Returns on an absolute and comparative basis

- Availability of real-time data

- Depth of research

We check if the platform provides actionable insights to make informed decisions.

How We Do It

- Hands-On Testing: I signed up for Mindful Trader to provide real insight. This is how I give my unique perspective. We’re unlike some other sites where they simply rehash marketing materials.

- Customer Reviews: What are other users saying? We look at reviews and customer feedback to gauge public opinion.

- Comparative Analysis: Finally, we compare each platform against competitors regarding features, pricing, and user experience.