In this Fundrise Review, we’ll take a look at one of the most popular real estate investing platforms and help decide if their product is right for you.

Quick Summary:

Fundrise is a real estate investment platform that allows accredited and non-accredited investors to gain exposure to commercial real estate starting at just $10.

Overall Rating:

Investment Options:

Tools & Features:

Ease of Use:

Fees:

Best For:

Buy and hold investors

Capital appreciation-oriented investors

PROS

- $10 minimum investment

- Strong track record

- Customized portfolio recommendations

CONS

- Limited liquidity

Fees

1%/year of AUM

Features:

Dividend re-investing

Multiple investment options

Auto investing

Mobile App?

Yes

Current Promotions:

$25 – $50 Referral bonuses

At A Glance

| Minimum Investment | $10 |

| Returns | 11.58% net of all fees across all clients 21 consecutive quarters of positive returns |

| Current Promotions | $25 – $50 worth of shares per referral |

| Fees | 1%/yr of AUM |

| Early Redemption | Yes |

| IRA Investing | Yes, for basic portfolio and up |

| Dividend Reinvesting | Yes |

| Auto Investing | Yes |

| Types of Investors | Accredited and Non-Accredited |

Who Should Use Fundrise?

Fundrise is best for…

- Investing with a small amount of money ($10)

- Diversification outside traditional stock market investing

- Individuals who can do their own due diligence.

About Fundrise

Established in 2010, Fundrise is one of the oldest real estate crowdfunding platforms. Fundrise offers people an alternative option to investing in real estate without the stress and costs of traditional real estate investing.

Accredited and non-accredited investors can invest in real estate through Fundrise’s wide variety of eREITs and eFunds with a minimum investment of $10.

The company boasts a wide variety of investment options and strategies, goal planning features, and a user-friendly investment dashboard.

More than 300,000 people use Fundrise today and have invested over $7 billion in properties throughout the United States. Since 2017, Fundrise has returned 21 consecutive positive quarters of returns.

Fundrise is based in Washington, DC, and was founded by Ben Miller, who has over 20 years of experience in the real estate industry.

How Does Investing With Fundrise Work?

With Fundrise, you are investing in either Fundrise eREITs or eFunds. eREITs and eFunds are comprised of a basket of non-traded real estate properties, from multifamily apartments to industrial complexes. The eREITs and eFunds aim to seek a combination of dividend distribution and capital appreciation, depending on the strategy.

When you open an account with Fundrise, they offer a wide range of account levels; Basic accounts require a minimum investment of $10, and its Advanced Portfolio requires a minimum investment of $10,000. The premium level is reserved for accredited investors only with a minimum investment of $100,000.

However, Fundrise’s most popular account is its Core Portfolio which has all the options and benefits most investors need. A Core account requires a minimum investment of $5,000.

You can create a customized investment strategy at the Core account level and above. Investors can customize their portfolio by diversifying across a wider variety of funds with specific objectives, such as income, growth, and balanced.

And once you open an account, you can view and manage your investments from one easy-to-use dashboard:

Fundrise Account Level and Minimum Investments

The Fundrise platform consists of five types of accounts with various minimum balance requirements. Depending on the type of account, you will have access to different investment options.

Fundrise’s most affordable option is its ‘Starter’ portfolio. This low-cost package starts at $10. The portfolio includes access to Fundrise’s registered products and dividend reinvestment, and auto investing.

If you open a ‘Starter’ portfolio, you can invest in the Income Fund, which focuses on cash flow generation, or the Flagship Fund, which focuses on income and capital appreciation.

However, the Starter portfolio does not have IRA access or other advanced functionality.

For $1,000, you can upgrade your account to the Basic Plan. With the Basic Plan, you can define your investment goals, open a taxable IRA, and invest in the Fundrise iPO.

Neither the Starter nor Basic plans grant access to Fundrise’s non-registered investment programs.

After that, there are 3 higher-level plans which include: Core, Advanced, and Premium. These plans have a higher minimum balance but also come with more advanced features, including additional investment options such as an Opportunity Zone Fund.

Why Invest In Private Real Estate?

Private real estate investing has shown year over to year to provide Income, Stability, and Risk-adjusted returns. Taking all three factors into consideration, real estate provides a tremendous opportunity to diversify your investment portfolio.

Income

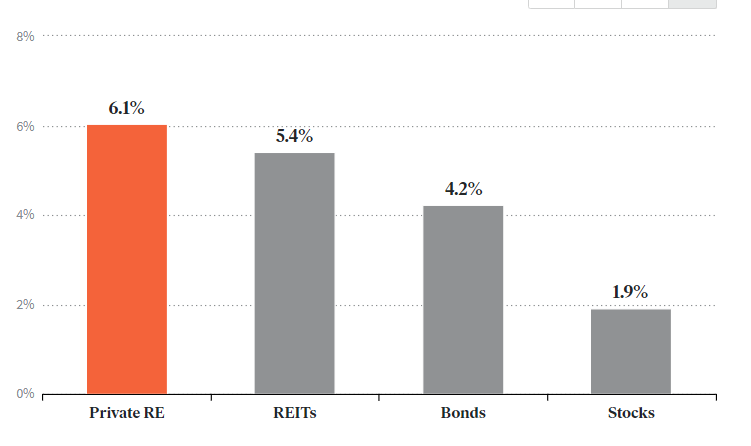

Over the past 20 years, NPI (the index that tracks private real estate performance), has averaged a higher rate than the yields of other major asset classes such as publicly-traded REITs, Bonds, and Stocks.

Stability During Economic Crisis

Private real estate has historically demonstrated a low correlation with both publicly traded stocks and REITs. When public sectors of the market have exhibited greater degrees of volatility and vulnerability to investor sentiment, real estate has been steady in comparison — especially during the past three major economic crises.

Risk-Adjusted Return

Of the four major asset types readily available to investors, private real estate generally mitigates risk while still prioritizing attractive returns, as shown below.

Investment Options

The Starter and Basic level accounts allow individuals to invest only in Fundrise’s registered products. At the Core level and beyond, investors have access to non-registered products as well.

Let’s take a look at all the investment options in detail…

Income Real Estate Fund [Recommended]

The Income Real Estate Fund is an innovative new real estate fund intended to generate a low-volatility income stream of cash distributions with a current 6.5% distribution rate. This fund was launched in April 2022 and will offer quarterly liquidity (in the form of quarterly repurchase offers) with zero penalties or costs associated with liquidating Fund Shares.

Best For: Income generation and if you do not want to lock your money up for a long period of time.

Open to: All portfolio levels

Current Distribution Rate: 6.5%

Objective: Income

Current NAV: $10 per share

Flagship Real Estate Fund

The Flagship Real Estate Fund has an investment objective to generate income, while also seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets.

Open to: All portfolio levels

Current Distribution Rate: 0.75%

Objective: Balanced

Current NAV: $13.44

eREITs

eREITs are a diverse family of funds, each of which pursues a focused real estate investment strategy. Fundrise typically allocates their clients’ portfolios to a combination of eREITs, calibrating each client to specified objectives and risk tolerance.

There are currently 11 active eREITs. Strategies span from income generation to Midwest Region strategies. eREITS are only available at the ‘Core’ level plan and above.

Open to: ‘Core’ level and above

Current Distribution Rate: Varies

Objective: Varies

Current NAV: Varies

| eREIT | Objective | Current Dividend | Inception |

|---|---|---|---|

| Growth eREIT | Appreciation | 2.46% | Feb 2016 |

| East Coast eREIT | Balanced | 0.70% | Oct 2016 |

| Heartland eREIT | Balanced | 2.67% | Oct 2016 |

| West Coast eREIT | Balanced | 2.43% | Oct 2016 |

| Development eREIT | Appreciation | 0.93% | Oct 2019 |

| Balanced eREIT | Balanced | 6.72% | Dec 2019 |

| Balanced eREIT II | Balanced | 0.81% | Jan 2021 |

| Growth eREIT II | Appreciation | 3.53% | Sep 2018 |

| Growth eREIT III | Appreciation | 3.00% | Feb 2019 |

| Growth eREIT VI | Appreciation | 0.83% | Dec 2019 |

| Growth eREIT VII | Appreciation | 0.85% | Jan 2021 |

Returns

From 2017 – 2021, Fundrise returned an average annualized return of 11.58%, net of fees across all clients. Compared to all public REITs, which returned 13.4% and 19.21% for the S&P 500.

It’s important to note that your total returns could vary depending on your chosen plan and investment objective.

Fundrise has had 21 consecutive quarters of positive returns, with their best quarter returning 9.40% and their worst quarter being 1.15%.

Both the S&P500 and all public REITs had only 17 consecutive positive returns, with their best quarters returning 20.54%/16.70% and worst quarters returning -19.60%/-25.42%, respectively.

| Year | Fundrise Returns |

|---|---|

| 2022 Q1 | 3.49% |

| 2021 | 22.99% |

| 2020 | 7.31% |

| 2019 | 9.16% |

| 2018 | 8.81% |

| 2017 | 10.63% |

Investment Strategies Explained

Fundrise has 4 real estate investment strategies: Fixed Income, Core Plus, Value Add, and Opportunistic. Fixed Income portfolios focus on income generation while opportunistic strategies focus on total return.

If you invest in an eREIT or eFund, the portfolio may consist of some, all, or a combination of the investment strategies listed below.

Fixed Income

Typical Return Profile

Cash flowing at acquisition

Income: 6-8%

Fundrise’s Fixed Income strategy seeks to generate above-market yields by providing creative and comprehensive financing solutions underpinned by high-quality real estate.

This strategy seeks to lend with a margin of safety to product types with high durability of demand (e.g., housing) and real constraints on new supply, thereby supporting property values.

Core Plus

Typical Return Profile

- Total Return: 8 – 10%

- 6 – 12 months to first cash flow

- Income: 4-6%

Their Core Plus strategy features stabilized real estate with a long investment horizon and moderate leverage, seeking to unlock additional value through focused asset management. This strategy seeks to buy quality assets at an attractive basis in growing markets across residential and industrial asset classes.

Value Add

Typical Return Profile

- Total Return: 10 -12%

- 12-18 months to first cashflow

- Income: 2 – 4%

The Value-Add strategy focuses primarily on acquiring existing properties below replacement cost and investing capital to increase their competitiveness. They focus primarily on acquiring reasonably-priced residential communities in growing markets where affordable rental housing is scarce.

Opportunistic

Typical Return Profile

- Total Return: 12 -15%

- 2-3 years to first cash flow

- Income: 0-2%

The opportunistic strategy seeks to acquire underutilized, well-located properties in the most dynamic markets. These business plans are the most complex and longest-dated that Fundrise has, but also carry the potential for the greatest reward.

Fees & Pricing

Fundrise charges a yearly asset management fee of 0.85% plus a 0.15% advisory fee, so 1%/yr. All dividends are net of fees. So for every $1,000 invested, you will pay $10 in fees.

Fundrise does not charge any transaction fees, sales commissions, or additional fees for enabling features on your accounts, such as dividend reinvestment or auto-invest.

Note: There may be costs associated with redeeming depending on when the request is made.

Fees Compared:

| Fees | Fundrise Real Estate Investment Trust | Blackstone Real Estate Income Trust | Starwood Real Estate Income Trust |

|---|---|---|---|

| Sales Commission | None | 3.5% | 3.5% |

| Annual Servicing Fee | 0.15% | 0.85% | 0.85% |

| Annual Management Fee | 0.85% | 1.25% | 1.25% |

| Carried Interest (Profits above 5% return hurdle | None | 12.5% | 12.5% |

Liquidity Features

If investors want to redeem their shares for the eREITs or eFund, they can place a redemption request at any time.

After a request is submitted, they typically process those requests quarterly for the eREITs, and monthly for the eFunds after a minimum 60-day waiting period.

Any eREIT or eFund redemptions processed before an investment is five years old will be subject to a flat 1% penalty. After five years, investors can request to redeem their shares at any time for their full value, with no penalty applied

It’s important to note that while under normal market conditions Fundrise seeks to provide investors with liquidity through the redemption plan, during a financial crisis, investors should expect us to pause the redemption plan long enough to allow enough time for whatever events may unfold.

Note: Investors in the Fundrise Income Real Estate Fund can redeem their shares quarterly with no penalty or cost.

Alternatives To Fundrise

| Features |  |  | |

|---|---|---|---|

| Overall Rating | |||

| Minimum Investment | $10 | $10 | $500 |

| Fees | 1% | None | 2% |

| Property Types | Varies | Residential | Multi-family |

| Open To All Investors? | |||

| Retirement Account Investing? | |||

| Current Promotions | $25 in shares for every referral | None | None |

| SIGN UP FOR FUNDRISE | Groundfloor review | DiversyFund review |

Is Fundrise Worth It?

Real estate in the asset classes is an investment with a long-term investment horizon. The potential for capital appreciation, portfolio diversification, and regularly distributed assets is alluring.

REITs can help investors to invest directly in properties without a huge amount of money required and managerial headaches of direct ownership. Furthermore, you can invest in assets outside of your region.

Yes, Fundrise is worth investing in if you want to diversify your portfolio outside of traditional stocks and bonds.